Andrew Hallam

13.04.22

The Investment Paradox

_

I know a guy who, in 2009, put everything his family had in a handful of technology stocks. He didn’t own a house. He didn’t own bonds. In 2018 he showed me his brokerage account statement. This guy, who saved relatively modest sums, grew that money to several million dollars. From 2009 to 2018, his compound annual return exceeded 30 percent a year.

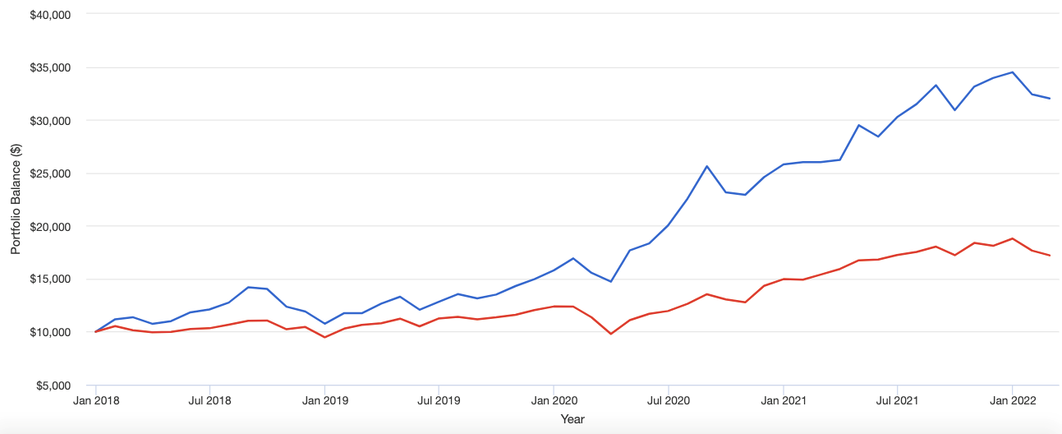

Since then, his portfolio has only done better. The aggregate return of his three largest holdings (Alphabet, Google and Apple) gained a further 250 percent from January 2018 to March 29th, 2022. They’re represented by the blue line below and compared to the US stock index, in red.

Source: portfoliovisualizer.com

A compound annual return exceeding 30 percent a year from 2009 to 2022 is spectacular. You might know someone who did something similar. But however tempting it might be to follow a strategy of buying hot, popular stocks, it’s good to remember the investment paradox:

Investment results sometimes have little correlation with the intelligence of the plan.

In 2017, 31 year-old Alex Honnold climbed the 3,200 vertical feet of Yosemite’s El Capitan without ropes. His preparation and achievement was documented in the film, Free Solo. A writer for The New York Times said, “Alex Honnold’s free solo climb of El Capitan should be celebrated as one of the greatest athletic feats ever.” In many circles, Honnold became a hero.

One of the experts interviewed in Free Solo says, “Everybody who has made free soloing a big part of their lives is dead now.” Some of them, arguably, were better climbers than Honnold. In Honnold’s case, his decision to climb El Capitan without ropes was celebrated as brilliant…because he succeeded. But if he fell, people would have called him foolish.

When we take risks with a concentrated portfolio of stocks, we aren’t going to die if things go south. But the same premise applies. As with people who climb without ropes, most of the people who do it eventually fall back to Earth.

History is filled with people who beat the market, until they didn’t. They include legendary investor Bill Miller, whose Legg Mason Value Trust fund beat the S&P 500 for 15 years in a row. They include the hedge fund maestro, Ray Dalio, who trounced the market for years, until the market trounced him. They include Cathie Wood, the outspoken visionary and fund manager of ARK Investments whose market-beating record looks more tenuous every day. Her flagship fund, ARK Innovation, lost a whopping 23.38 percent in 2021. And over the first three months of 2022, it fell a further 27.39 percent.

Trying to beat the market can be hazardous to our wealth, especially if we shun diversification. But more importantly, we shouldn’t judge the soundness of a plan based on the outcome, whether we’re climbing mountains or investing money. This implies to index funds, too.

For example, a few years after I wrote Millionaire Teacher, plenty of readers emailed to say, “Thank you! I’ve made a lot of money with index funds, so your strategy works.” Unfortunately, they judged the intelligence of the strategy based on the result, and not the premise itself. They didn’t understand that whether they made money or not, a diversified portfolio of index funds will beat about 80 percent of professionally managed money invested on an equal-risk adjusted basis. That’s an irrefutable, academic reality, whether the markets rise, flat-line or sink. It’s that premise, which makes it a sound strategy, regardless of how it performs over a year or a decade.

Without understanding this, someone could have started investing in the year 2000, added money every month, watched their portfolio lose value for almost three years and said, “It’s a bad strategy because it didn’t make money.” Without understanding why index funds win, they wouldn’t have realized that, despite not making money, they still thumped most professional investors on an equal risk-adjusted basis.

My friend who made a killing with a handful of technology stocks believes his strategy was smart. He confirms the intelligence of what he did based on the outcome. But he took outsized risk. Like Hannold, the odds that he would fail were greater than the odds he would succeed.

I’m thrilled that he did well. But going forward, if you want to build a portfolio based on a smart investment strategy, there are two things you should do:

1. Understand the downside of a concentrated portfolio compared to a diversified one.

2. When choosing your allocation of stocks and bonds, understand how different allocations have performed in the past. Look at the “worst case” historical scenario to see what could go wrong. This can help you make an educated decision

If your portfolio doesn’t perform well over a designated period, that doesn’t make your strategy bad. Nor does a soaring portfolio or a soaring stock market make your investment strategy good. That’s the investment paradox.

For my part, I prefer a low-cost portfolio of stock and bond market index funds. I won’t beat the market. And when stocks fall, my portfolio will too. But I’ll summit my own El Capitan, beating about 80 percent of the pros in the process. And best of all, I’ll be climbing with ropes.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.