_

Cryptocurrencies

Digital currencies are known for their volatility, but have also offered high returns. Up to the challenge? Discover the 44 currencies available on our platform.

Your advantages

Promising new asset class

Cryptos are a promising new market with rising global liquidity levels

High volatility

Cryptos’ high volatility presents both increased risks, but also unprecedented opportunities

Crypto never sleeps

You can trade cryptos around the clock – 24/7

Award winning platform

_

Swissquote has swiftly risen to prominence as one of the leading crypto platforms, winning a prestigious SIQT award: Top crypto platform in the DACH region.

Swissquote was awarded for the diversity of the crypto offering, setting itself apart with a wide range of cryptocurrencies and crypto-asset products including crypto ETPs, options and futures.

Swissquote is the benchmark for your crypto investments, backed by the security of a regulated Swiss Group.

The Swissquote edge

_

• The best of all crypto worlds: Developed by the Swissquote Group, the SQX exchange aggregates liquidity from major external crypto exchanges, as well as Swissquote and its clients, for more enhanced prices.

• The real thing: We don’t just provide exposure to crypto via derivatives. You can trade and hold actual crypto assets in your Swissquote wallet.

• Swiss group safety: Enjoy the security of a regulated and listed Swiss group.

Major cryptocurrencies

Swissquote offers a total of 44 cryptocurrencies and an infinity of opportunities. Learn more about the benefits of each digital currency available on our platform.

- BitcoinThe king and forefather of cryptocurrencies

- EthereumThe smart contract platform

- LitecoinFaster than Bitcoin

- RippleThe cross-border payment champion

- Bitcoin CashBitcoin revisited

- ChainlinkDecentralised information

- Ethereum ClassicThe purists’ choice

- EOSCompetition for Ethereum

- StellarLimitless payment

- TezosThe Ethereum Killer

- 0xDecentralised exchange

- CardanoNext generation blockchain

- UniswapDecentralised exchange platform

- AavePeer-to-peer lending

- CosmosThe blockchain network

- AlgorandDecentralisation and speed

- FilecoinDecentralised data storage

- MakerThe system behind Dai

- CompoundCompeting with Aave

- DogecoinThe internet meme

- PolkadotNext-generation blockchain protocol

- SolanaOne of the champions of speed

- PolygonThe fast lane of the Ethereum network

- AvalancheFast as lightning

- The SandboxThe decentralised gaming platform

- Axie InfinityThe 2.0 generation of Tamagotchis

- ApeCoinCollectibles

- AudiusDecentralized protocol for audio content

- ChilizThe world's tokenized sports exchange

- EnjinGaming community platform

- Hedera HashgraphA public ledger with permissioned governance

- DecentralandVirtual world on the ethereum blockchain

- BancorAn on-chain liquidity protocol for asset swaps

- GalaAn NFT gaming ecosystem

- USD CoinThe safer stablecoin

- Lido DaoThe token that governs Ethereum

- The GraphThe Google of blockchain

- RenderThe artist of cryptocurrencies

- Immutable XNo.1 for blockchain gaming

- Ethereum Name ServiceA crypto name to be remembered

- Internet ComputerWings for the Cloud

- OndoSealed exchanges

- Euro CoinThe euro at a crypto pace

- NEAR ProtocolPerformance without the expense

To the moon!

_

Cryptos are one of the best performing asset classes over the past few years, and they still post impressive growth spurts regularly.

Enjoy the crypto-ride with Swissquote.

How to buy and sell cryptocurrencies at Swissquote

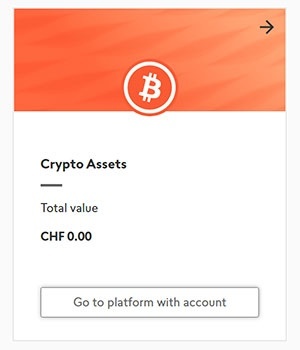

From your account overview

Scroll down to the crypto-assets section, click on "Go to platform with account", then click "Trade" on the desired currency pair.

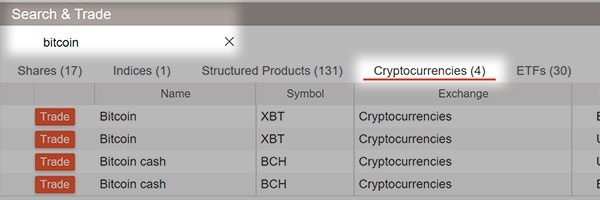

Via our eTrading platform

Type the desired crypto, for instance "Bitcoin" or "BTC" in the Search & Trade widget. Select the "Cryptocurrencies" asset class, then trade.

Digital Assets are unregulated in most countries and consumer protection rules do not apply. As highly volatile speculative investments, Digital Assets can become illiquid at any time, and are not suitable for investors without a high risk tolerance. Make sure you understand each Digital Asset before you trade.

Crypto traders are also interested in …

_

FAQ - General questions

_

You can trade cryptocurrencies directly from your Swissquote mobile app, the eTrading platform or the cryptocurrency service in your eBanking portal.

You must hold a Swissquote Trading Account with cash available in EUR and/or USD, as currently cryptocurrencies can only be traded with these two currencies.

There are no custody fees. The account maintenance fee is free if you trade stocks and/or ETFs at least once a month, and EUR 15 per month when you don’t.

Our trading account includes all that you need for your investing journey. To find out more about your simple and transparent pricing, visit the pricing section of our website.

The minimum buy/sell amount for Cryptocurrencies is equivalent to EUR/USD 25.

The performance graph is available on the dedicated Crypto Asset platform under My account > Account overview > Crypto Assets > Trade > Show details.

Settlement is instantaneous.

With the safety of our clients’ digital assets as our number one priority, Swissquote operates state-of-the-art security systems including multi-signature wallets, offline storage of cryptographic materials and strict access-control policies. We rely on redundant custody solutions, including ours and external partners’ to store client digital assets. Only a minimal amount of digital assets are held with sub-custodians, such as those necessary for day-to-day trading activities with the relevant liquidity providers.

Swissquote Bank Europe solely uses Swissquote Bank SA, a Finma-regulated bank in Switzerland, as its digital asset custodian. Swissquote Bank SA relies primarily on its own redundant custody solutions with only a minimal amount of digital assets held by its liquidity providers acting as sub-custodians for day-to-day trading activities requirements. These liquidity providers are: Bitstamp Europe S.A. (Luxembourg), Bitstamp Limited (United Kingdom), Ltd by Coinbase Europe Limited (Ireland), Ltd and CB Payment, Ltd. (United Kingdom)

| Digital Assets | Service | Sub-custodians |

|---|---|---|

| ETH, DOT, SOL and XTZ | Staking | Coinbase Custody Trust Company, LCC (USA) |

While the treatment of Hard Forks and similar events (incl. "airdrops" and other token allocation events) is uncertain from a legal and practical perspective, Swissquote’s current policy in this regard is to make its best efforts to have its concerned clients benefit from such events, the way Swissquote deems appropriate. For more details, please refer to our Policy on Hard forks and similar events and section 12 of our Digital Assets Contract.

Swissquote does not provide tax advice. It is your responsibility to fulfil any tax obligations that you may have depending on your individual circumstances. Swissquote provides details of your cryptocurrency positions in January of each year to help you fulfil tax filing obligations. This information can be found in the «Documents» section of your account.

You cannot transfer cryptocurrency in and out of your Swissquote account.

Swissquote will continue providing access to XRP for as long as the situation allows it. Please be aware that the situation can change quickly. For this reason, it is important that you regularly review your cryptocurrency holdings, specifically XRP, and whether you remain comfortable with the associated risks. Read more about the risks associated with Ripple here.