Life Insurance

Take full advantage of Luxembourg’s Insurance Wrappers

Approved custodian by the CAA

Tax neutrality

Maximum security and protection

Luxembourg-based insurers are overseen by the Commissariat aux Assurances (CAA), Luxembourg’s dedicated insurance regulator.

Enforcing strict conformity with international and EU standards, Luxembourg provides an advanced and secure framework which guarantees customers maximum security.

Swissquote has been approved by the Commissariat aux Assurance (CAA) as custodian for insurance wrappers and partners with leading providers and insurers.

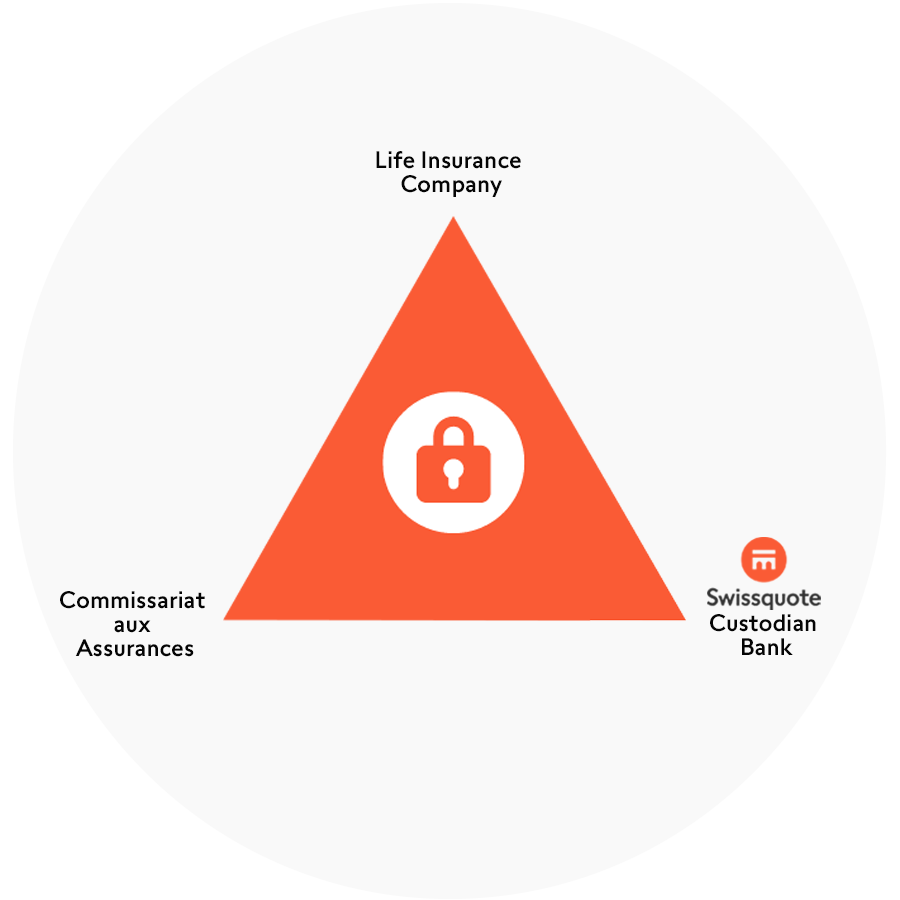

Luxembourg’s ‘triangle of security’ offers an extra degree of investor protection, unique in Europe.

_

- The regulator must approve the choice of the insurer’s custodian bank and can freeze the assets of a life insurance company in the event of a risk.

- A tripartite agreement between the insurance company, the regulator and the custodian bank specifies that the custody of assets is governed by all three parties. Furthermore, assets linked to life insurance contracts must be separated from the insurance companies’ other assets and be deposited in a segregated bank account.

- The custodian bank must also segregate assets linked to life insurance contracts from other assets. In addition to the triangle of security, Luxembourg boasts the ‘Super Privilege’ guarantee. This ensures that holders of insurance contracts have a preferential claim over all other creditors in case of default.