Swissquote Vie

The security of Luxembourg life insurance.

The power of online investing.

Attractive and

transparent fees

• Management fees from 0.25%

• Custodian fees from 0.06%

• From €14.95 per share or ETF transaction

.

.

A complete

investment universe

• Over 20 currencies

• Equities and ETFs on 30 international markets

• Funds in institutional units.

.

.

The protective framework

of Luxembourg insurance

• Your assets deposited with Swissquote Bank Europe

• Luxembourg's tax neutrality

• The protection of the "security triangle”

.

The solution of choice to manage your wealth

Luxembourg life insurance is the tool of choice for wealth planning and capital protection. Available from €250,000, it combines perfectly with Swissquote Bank Europe's online investment solutions.

Swissquote has been approved by the Commissariat aux Assurances (CAA) as a custodian bank for life insurance contracts, and works with all leading insurers. Swissquote Bank Europe is not a life insurance broker for these contracts.

Self-management

Manage your own Specialised Insurance Fund (SIF)

Your life insurance policy, when combined with a Swissquote account, gives you total control and flexibility over your investments. Manage your specialised insurance fund and choose the equities, ETFs, investment funds and currencies that make it up.

Advisory management

Be accompanied by your advisory manager or IFA

Assisted by your Independent Financial Adviser, you'll have access to a broad investment universe including equities, international ETFs, institutional fund share classes and all major currencies. Benefit from direct online access and check your portfolio any time.

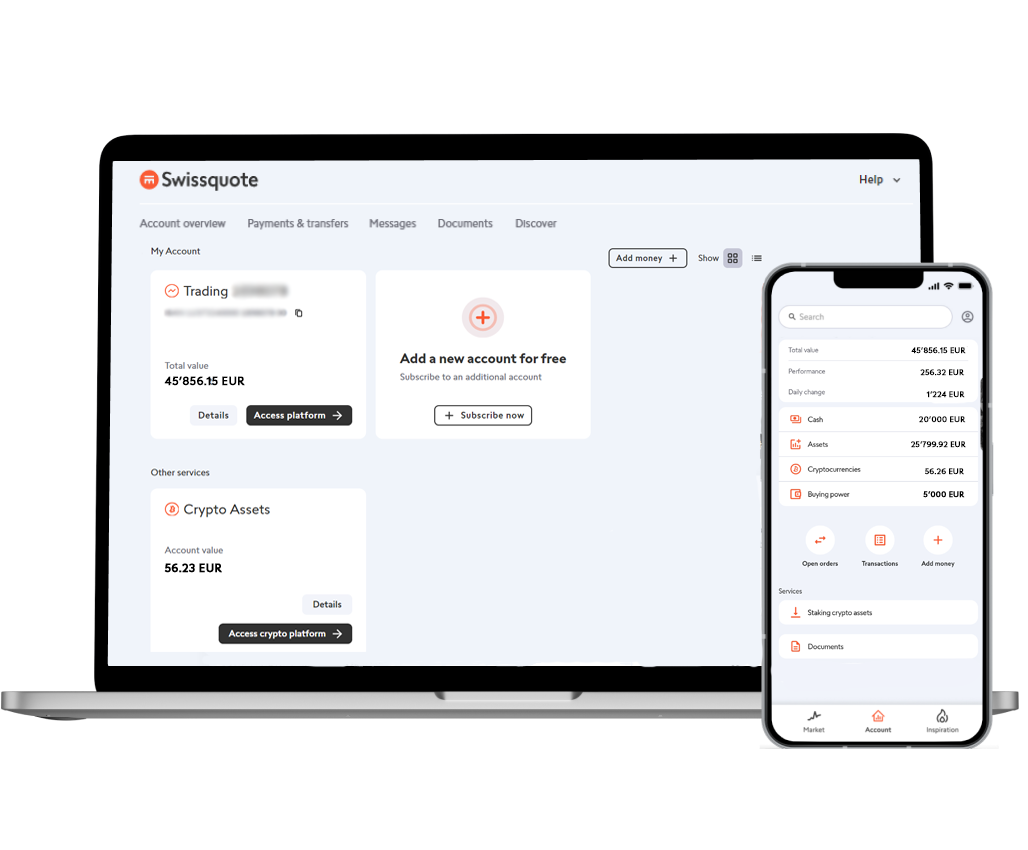

The power of our online platforms

_

As the leading online investment bank in Luxembourg and Switzerland, our investment platforms give you real-time access to your portfolio and the financial markets.

A unique protection mechanism in Europe

The security triangle

Your assets are deposited in a separate account from the insurer's assets and with a CAA-approved custodian bank that carries out regular checks on the insurer's reserves.

Super privilege

In the event an insurer defaults, you may recover your assets ahead of the company's other creditors. They include the government, social security bodies, shareholders and employees.

Tax neutrality

Luxembourg applies the principle of tax neutrality, and does not impose any tax deductions on your policy. Your insurance contract is tax-compliant with the rules in your country of residence.