One account

for better investing

There’s no better home for all your international investments than our multi-currency trading account.

It’s perfect for investors or traders, at home or overseas.

Simply manage your cash and investments through one convenient account, with access to 20+ currencies

One convenient

account with

20+ currencies

Available fiat currencies

| Americas | Europe | Asia-Pacific | MENA |

|---|---|---|---|

| USD | EUR | SGD | AED |

| CAD | GBP | HKD | BHD |

| MXN | CHF | AUD | ILS* |

| SEK | JPY | SAR | |

| DKK | NZD | TRY* | |

| NOK | THB* | QAR | |

| HUF | CNH* | ZAR | |

| PLN |

* Subject to certain restrictions, please contact us.

Based in Luxembourg, an 'AAA' country renowned for investor protection, the FGDL EUR 100'000 deposit guarantee brings added reassurance.

Spot precious metals

| Gold | XAU |

|---|

Trade Gold with Swissquote

_

Gold trading is one of the world’s oldest investment. Considered as a hedge, a safe haven or a diversifier, the yellow metal remains one of the most popular assets in uncertain times.

Swissquote has just launched Spot Gold trading (XAU), side by side with other currency pairs, allowing you to gain exposure to the commodity.

The many ways Swissquote does gold

Whether you’re looking to invest in gold as part of a long-term strategic allocation, or if you want to speculate on gold prices in the short term, we have the instruments to suit your needs:

_

XAU spot gold

Get direct exposure by buying fractional ounces of gold – without turning your house into Fort Knox.

_

Mining stocks

Invest in the companies that mine and sell the precious metal.

_

ETFs & ETCs

Use this passive method to track the price of gold or of a basket of gold mining companies.

_

CFDs

CFDs offer the ability to use financial leverage to trade larger amounts than your original deposit for speculative or hedging strategies.

_

Warrants & Certificates

Structured products are another investment alternative for trading gold with leverage, booster and barrier.

_

NEW - Futures

Hedge price risk, or take long or short positions with the world’s most liquid precious metals futures market.

FAQs on XAU Spot Gold

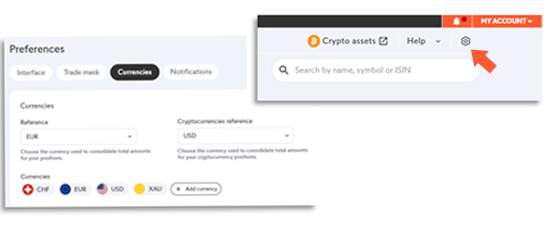

To buy fractions of gold ounces at spot price on your eTrading account, you need to activate XAU as a new currency in your multi-currency account. Follow the steps:

Go to Preferences

Click on currencies

Then Add currency

Select XAU

Yes, Swissquote Bank purchases the precious metal at the Loco Zürich gold market.

The gold you purchase with your Swissquote account is called unallocated. It means that you own an undivided, fractional interest in the physical gold owned by Swissquote Bank.

No, Swissquote only facilitates buy and sell. As the Bank is your sole counterparty, gold may not be transferred.

Physical delivery of your gold position is not available.

Swissquote offers a transparent tiered commission spread based on order value. Access the spreads on the pricing page under currency conversion.

We apply custody fees of 0.20% per annum (0.10% for VIPs) that include storage and insurances*.

* + standard VAT rate for EU residents.

Exchange money online

Easily convert currencies in real-time on the eTrading platform or mobile apps.

Lock in competitive rates

Reduce forex fees and save money with real-time currency exchange.

Invest in global markets with ease

Trade overseas markets and settle in local currencies, or any currency of your choice among 20+.