Lock your crypto in a golden cage

Staking basically means that you reap the fruit of your crypto’s labour. Sounds too good to be true? Not at all. All you have to do is hold your crypto in place while the blockchain puts it to work.

What is staking?

_

Staking in crypto is a process that allows you to earn rewards while blocking certain digital currencies (put them «at stake») via a consensus feature called Proof of Stake (PoS) during an amount of time defined by you. Your locked assets are used to achieve a consensus mechanism that is required to ensure the security of the network and the validity of each new transaction. That’s why crypto stakers are also called «validators». For locking assets and providing services to the blockchain validators are rewarded with new coins.

Nice side effect

Proof of Stake is a consensus algorithm that reduces the energy-intensive processes required by classic crypto mining. The transaction speed is increased while the blockchain is greener.

Award winning platform

_

Swissquote has swiftly risen to prominence as one of the leading crypto platforms, winning a prestigious SIQT award: Top crypto platform in the DACH region.

Swissquote was awarded for the diversity of the crypto offering, setting itself apart with a wide range of cryptocurrencies and crypto-asset products including crypto ETPs, options and futures.

Swissquote is the benchmark for your crypto investments, backed by the security of a regulated Swiss Group.

Previously released cryptos

Lending or Staking – Enjoy more ways to grow your crypto with rewards and benefits

What is lending?

_

Crypto lending has grown significantly in recent years. Our service lets you lend your crypto holdings to borrowers such as cryptocurrency exchanges. Swissquote offers extra protection by lending to reputable institutions and maintaining collateral of at least 105% in traditional financial instruments such as cash and transferable securities. When activating lending on your digital assets portfolio, you unlock discounted fees on your crypto transactions.

Find out more: Contact us

Staking with Swissquote

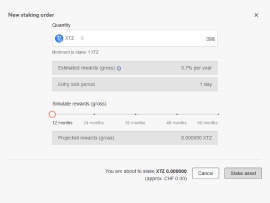

Currently on our staking menu: Ethereum (ETH), Polkadot (DOT), Solana (SOL) & Tezos (XTZ)

Here is how to get started:

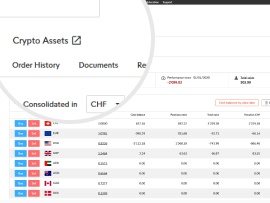

1. Connect to your trading account and click on the crypto plug-in

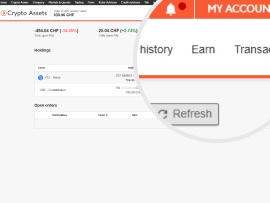

2. Select «Earn»

3. Define your staking parameters and confirm by clicking on «Stake»

Terms and conditions of staking

Staking and lending are complex processes and services that involve high risks. For further information on the risks associated, please consult the disclosures available on our platform.

Build your digital asset portfolio with the first bank

in Europe that let’s you invest directly in cryptocurrencies

Digital Assets Risk Disclosure

Digital Assets are unregulated in most countries and consumer protection rules do not apply. As highly volatile speculative investments, Digital Assets can become illiquid at any time, and are not suitable for investors without a high risk tolerance. Make sure you understand each Digital Asset before you trade.