Start investing

with 5'000 EUR / USD / GBP

No Hidden Fees

All-in annual costs from 0.92%.

No entry or exit fees.

Cost Efficient

Intelligently diversified in low-cost ETFs and index funds.

Simple and Flexible

Automatic rebalancing and investment of new funds.

What’s a Smart Portfolio?

_

Swissquote Smart Portfolios are designed to put your investments on track for the long-term. Choose a risk profile and a currency (EUR, GBP and USD), fund your account with minimum 5'000 EUR/USD/GBP then top it up at your convenience.

Your portfolio is professionally managed by a leading asset manager to ensure diversification, and regularly rebalanced to keep you invested in assets that match with the risk profile you have selected. And with online access to your account valuation, you will always know exactly where you stand.

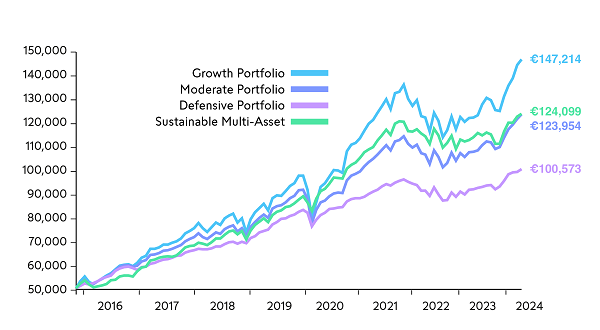

Investing can help you grow your money

_

See how an initial investment of EUR 50'000 with monthly top ups of EUR 500 has performed, net of all fees, since October 2015.

Performance as at 26/04/2024 - Class D2 EUR

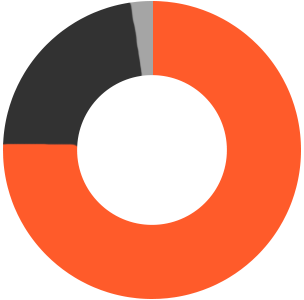

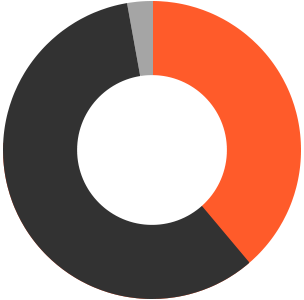

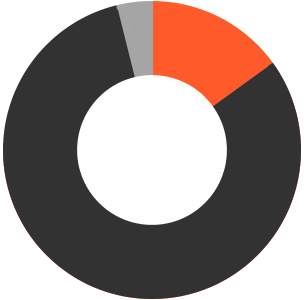

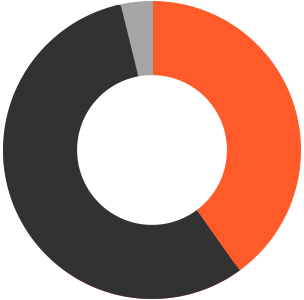

Four investment profiles

to match your objectives

Fixed Income Equity Alternatives

Want to put your investments on auto-pilot?

Apply for an account now.

All the services you need,

with low and transparent pricing.

Included Services

_

• Portfolio management by BlackRock, the world’s largest investment manager with over USD 6 trillion in assets under management, with automatic rebalancing and investment of new funds

• Account domiciled in Luxembourg

• Multi-currency account

• Premium client servicing via phone and email (9am to 10pm CET)

• Online account access to monitor your investments

Annual Costs

_

| Portfolio value (EUR/GBP/USD) | Account costs |

|---|---|

| On the first 50'000 | 0.90% |

| On the next 50'000 | 0.60% |

| Over 100'000 | 0.40% |

| Portfolio | Product costs |

|---|---|

| Defensive, Moderate, Growth | 0.50% |

| Sustainable Multi-Asset | 0.89% |

Other fees

• Zero Entry fees (vs 5% Prospectus)

• Zero Redemption fees

• Zero Trading or transaction fees

• Zero Custody fees

• Zero Exit fees

FAQs

_

| Minimum investment amount | 5'000 EUR/USD/GBP |

| Minimum cash transfer | No minimum amount |

| Minimum top-up amount | Once your cash balance reaches 100 EUR/USD/GBP, it will be invested in your Smart Portfolio |

Smart Portfolios are available in EUR, USD and GBP.

Your initial cash transfer will be automatically invested in the investment you selected in your account application. Available cash is invested the following day.

You can top up your Smart Portfolio by transferring money to your account, either as a one-off payment made at your convenience, or by setting up regular payments by standing order. Once there is 100 EUR/USD/GBP or more in your account, your available cash balance will be invested in your Smart Portfolio the following day. Your account details can be found under Payments & Transfers.

Yes, you can transfer money in any of the 20+ currencies available. Your cash will then be converted into the currency of your chosen portfolio, prior to the investment date for the month. Standard FX rates will apply.

You can switch to a lower or higher risk profile online, or change your strategy currency, at no cost.

The switch is operated in two steps. First, you will need to stop your current strategy, using the Stop button in your Smart Portfolio. Once your strategy has been closed, you can change your investment profile. Go to Settings and select your new profile or currency. To activate your new strategy, please press the button Reactivate. Your available cash will then be invested the following day.

You can access the pricing details and how the fees are calculated on the pricing page for Smart Portfolios.

There is no minimum holding period for Smart Portfolios. You can sell part or all of your portfolio at any time but access to your funds is subject to trade settlement.

To redeem funds please log into your account and request a withdrawal for the required amount under Payments & Transfers > Funds Withdrawal. The funds will be transferred on settlement.

If your request is urgent, please do not hesitate to contact us directly. E-mail our Luxembourg-based investment representatives at clientservices@swissquote.lu or call us on +352 2603 2003.

You can hold multiple Smart Portfolios serving different investment horizons, purposes or currency exposure. To create an additional Smart Portfolio, please open a new account by completing our online form here.

You can review the performance of your strategy on the Smart Portfolio platform. The performance is expressed both in terms of absolute performance (actual performance of your investment, in amount) and Time Weighted Rate of Return (historical performance of your portfolio, in percentage). Click on the indicator of your choice to reflect the performance in the chart.

The Key Information Document is a 3-page standardised document provided by the fund company – BlackRock. Each fund share class has its own KID. It gives you specific information about the fund, such as its objectives and investment policy, its risks, costs and potential gains and losses. It’s designed to help you compare the fund with other products, and decide if it meets your needs. You can download the relevant KID below:

KID BlackRock Managed Index Portfolios – Defensive D2 EUR

KID BlackRock Managed Index Portfolios – Defensive D2 GBP H

KID BlackRock Managed Index Portfolios – Defensive D2 USD H

KID BlackRock Managed Index Portfolios – Moderate D2 EUR

KID BlackRock Managed Index Portfolios – Moderate D2 GBP H

KID BlackRock Managed Index Portfolios – Moderate D2 USD H

KID BlackRock Managed Index Portfolios – Growth D2 EUR

KID BlackRock Managed Index Portfolios – Growth D2 GBP H

KID BlackRock Managed Index Portfolios – Growth D2 USD H

KID ESG Multi-Asset Fund – Class D2 EUR

KID ESG Multi-Asset Fund – Class D2 USD H

We invite you to refer to the prospectus for additional information about the fund's investment strategy.

Prospectus BlackRock Managed Index Portfolios

Prospectus ESG Multi-Asset Fund

Product Details

BlackRock Managed Index Portfolios – Defensive D2 EUR

BlackRock Managed Index Portfolios – Defensive D2 GBP H

BlackRock Managed Index Portfolios – Defensive D2 USD H

BlackRock Managed Index Portfolios – Moderate D2 EUR

BlackRock Managed Index Portfolios – Moderate D2 GBP H

BlackRock Managed Index Portfolios – Moderate D2 USD H

BlackRock Managed Index Portfolios – Growth D2 EUR

BlackRock Managed Index Portfolios – Growth D2 GBP H

BlackRock Managed Index Portfolios – Growth D2 USD H

ESG Multi-Asset Fund – Class D2 EUR

ESG Multi-Asset Fund – Class D2 USD H