Andrew Hallam

06.02.24

Why It’s The Wrong Time To Avoid Global Bond ETFs

_

I didn’t say she should eat a bar of soap. But the expression on her face said I might as well have. The woman in the second row leaned forward and put up her hand.

I was giving an investment talk at United World College, in Singapore. I showed a long-term chart of the global stock market, and recommended a global stock index as the backbone to a smart portfolio.

When the woman had a chance to speak, she asked, “Why would anyone want stocks in their portfolio? Stocks don’t make money anymore. Bonds have beaten stocks for years.”

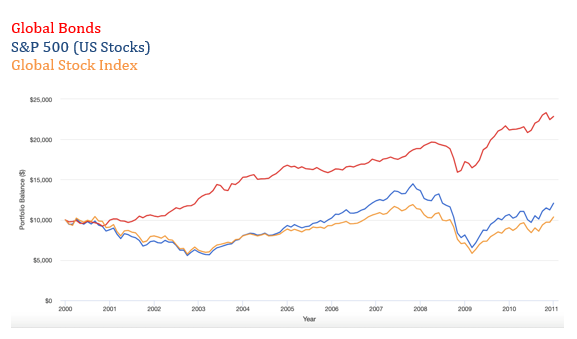

I was speaking to this audience in 2011. And she was right about one thing. From January 2000 to January 2011, stocks looked like cats trying to swim upstream. Over those 11 years, the S&P 500 of large US stocks averaged 0.32 percent per year. The global stock index averaged 1.73 percent per year.

Meanwhile, global bonds averaged 7.8 percent over the same time period.

Like so many people, she wanted to chase what had risen and shun what had dropped.

Global Bonds Thumped US and Global Stocks

January 2000-January 2011

“We shouldn’t buy stocks,” she said. “We should only buy bonds.”

Such instincts to chase “patterns” wormed their way into our DNA. It might have begun with our hunter and gatherer days.

For example, when tigers attacked our ancestors’ villages, people got eaten. As a result, we would have learned to run. If wild turkeys waddled in front of a group of hunters, our ancestors would have rushed them and devoured them for dinner.

This instinct to run from danger and towards opportunity helped us survive. Unfortunately, these same instincts make us really bad investors. We run towards investments that appear to have recently fed a lot of people. And we run away from investments that have appeared to dish out pain.

Unfortunately, this Neanderthal-like urge typically costs us money…especially in the long run.

Broad stock market indexes never stay down. In fact, after a bad year (or several, as was the case from 2000-2011) they’re heavily poised to fly and earn big returns.

That woman I met in 2011 was deciding with her gut. Understandably, she tapped into her ancestors’ logic. She then (as many of us do) sought stories from others that confirmed her fears.

But that cost her a lot of money. From January 2011 to January 2024, US stocks gained 379 percent: a compounding average of 12.82 percent per year. Global stocks gained almost 200 percent: 8.79 percent per year.

In sharp contrast, global bonds gained just 1.08 percent per year over the same time period.

Get International Investing insights

in your inbox once per month

Now let’s fast-forward to today. Over the 3 years ending December 31, 2023, global bonds dropped by a compounding average of 6.08 percent per year. That’s a gut-wrenching plunge.

So, what do you think new investors (and those influenced by instincts) are saying right now?

Many are avoiding bonds. I saw one such poster on a financial Facebook group write: “I know that people recommend building a portfolio of stock and bond market ETFs. But bond ETFs haven’t made money for several years. They’re down a lot. I don’t think anyone should bother with bonds.”

When a broad asset class is down, the odds of strong future performance are better than ever. And yet, that’s exactly when the average person runs away.

I’m not suggesting that you sell your stock market ETFs in favour of bond ETFs. Instead, maintain a consistent allocation between the two.

Yes, diversified portfolios invested 100 percent in stocks typically beat more diversified portfolios of stocks and bonds, over 15+ year periods. But how an allocation performs, and how you perform with a specific allocation are often two different things.

Can you handle big drops? Will they cause you to speculate? Will they cause you to stop investing, or sell some of your shares?

If your answer is “maybe,” then build a diversified portfolio of stock and bond ETFs. With such products, you’ll keep investment costs low. And the combination of stocks and bonds can collar your emotions. That might help you earn better lifetime returns.

If you’re Canadian or Australian, you could make this process easy. Select one of the fully diversified, all-in-one portfolio ETFs mentioned in this story.

If you’re from mainland Europe, I believe these are the best funds for you.

And for British investors, here’s what I recommend.

Just resist the urge to tap into your DNA.

We no longer have tails. So we shouldn’t be chasing them.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.