Andrew Hallam

16.01.2019

Why Having Bonds In Your Portfolio Can Help Boost Returns

_

Most investors know they can make much more money with stocks than they can with bonds. But in real-world settings, most investors should include both asset classes in their portfolios. Doing so can actually help them boost returns.

Michelle Ahoy’s heart slumped as she looked at her investments. In 2018, her portfolio recorded its first calendar-year loss. Measured in Canadian dollars, it dropped 2.57 percent. That doesn’t mean she didn’t invest well. The 40-year old Canadian followed Nobel Prize winning research by investing in a diversified portfolio of low-cost ETFs.

Michelle didn’t like seeing her portfolio value drop. But stocks don’t always rise. On average, stocks climb roughly two out of every three calendar years. However, there’s no discernible pattern. Sometimes, they go on multiple-year upward runs. Other times, stocks languish for years or fall through the floor. That’s why investors should diversify–owning stocks and bonds.

I know what you might be thinking: Bonds are boring. Global interest rates are low. Bonds pay paltry interest.

But when stocks fall, bonds are parachutes. Short or intermediate term government bond indexes never fall as far. Sometimes, they even rise. There’s much more to bonds than a paltry interest rate.

The Short-Term Benefit Of Bonds When Stocks Fall

In my book, Millionaire Expat, I listed portfolios for investors of different nationalities and risk tolerances. In 2018, the balanced portfolios with stocks and bonds beat the higher-risk portfolios that were more heavily focused on stocks.

Note the British portfolios below. Each includes UK stocks, Global stocks and UK bonds. But the Balanced Portfolio has 40 percent exposure to UK government bonds. Measured in British pounds, the Balanced Portfolio dropped just 3.96 percent in 2018. The Aggressive Portfolio includes just 10 percent in UK government bonds. It dropped 6.4 percent in 2018.

Portfolios With Higher Bond Allocations Won In 2018

| Fund Name | Fund Includes | Ticker Symbol | Balanced Portfolio Allocation | Aggressive Portfolio Allocation | Individual Fund Return for 2018 |

|---|---|---|---|---|---|

| Vanguard UK FTSE 100 Stock Index | Large British Stocks | VUKE | 20% | 25% | -8.76% |

| Vanguard UK FTSE 250 Stock Index | Small and Mid-Sized British Stocks | VMID | 10% | 15% | -13.12% |

| Vanguard FTSE All-World ETF | Global Stocks | VWRL | 30% | 50% | -4.69% |

| iShares UK Gilts 0-5yr ETF | Short-term UK government bonds | IGLS | 40% | 10% | +0.13% |

| Total Portfolio Return For 2018 | -3.96% | -6.4% |

Source: Morningstar UK; Measured in British pounds; Millionaire Expat, page 285

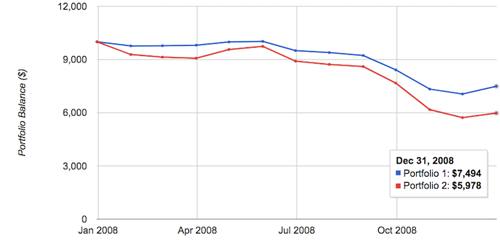

Bonds are little angels when stocks fall even further. For example, in 2008 global stocks dropped more than 40 percent. That would have turned $10,000 into $5,978. But more diversified portfolios (60 percent global stocks, 40 percent global bonds) didn’t fall as far. The same $10,000 would have dropped to $7,494. That would have been easier on the nerves.

100% Global Stocks versus 60% Global Stocks and 40% Global Bonds 2008

Source: portfoliovisualiser.com

Skeptics might say, “Long-term, stocks crush bonds, so why bother with bonds?” Such critics are correct. Stocks beat bonds over long time periods. But life isn’t a petri dish. Something called, loss aversion, usually breaks the glass.

According to research by psychologists Daniel Kahneman and Amos Tversky, people react more strongly to the pain that comes with loss than they do to the pleasure that comes with an equal gain. When stocks fall hard, such pain becomes real. When they see big losses, many investors give up on their long-term plans, or they start to speculate.

Consider the years between 2000 and 2018. Portfolios comprising 60 percent global stocks and 40 percent global bonds beat portfolios comprising 100 percent global stocks. That might not happen again for a really long time. But that’s not my point.

100% Global Stocks versus 60% Global Stocks and 40% Global Bonds

2000-2018

Source: portfoliovisualizer.com

Note: The Balanced Portfolio was annually rebalanced back to its original allocation at the start of each calendar year

As seen above, global stocks (in red) fell heavily between 2000 and 2003. They fell heavily again in 2008. The diversified portfolio (in blue) didn’t fall as far during either market drop. Investors with portfolios comprising 100 percent stocks face more ups and downs. This often causes them to do silly things.

For example, Morningstar publishes Mind The Gap each year. It shows that investors routinely underperform the market and the funds they own. Sometimes, such differences are huge. For example, during the ten-year period ending December 31, 2013, investors had to stomach a lot of hurt. They saw stocks drop heavily from 2000-2003. They saw stocks plummet in 2008. They saw a big mid-year decline in 2010. And because investors dislike losing money more than they enjoy making gains, they acted foolishly.

The average investor tried to time the market. They jumped out when stocks fell (or they lowered their monthly investment contributions). They often jumped back into stocks (or they boosted their monthly contributions) after stocks had risen. Morningstar proves it.

The typical investor in U.S. stock market funds averaged a compound annual return of just 4.8 percent between 2003 and 2013. That would have turned $10,000 into $15,981. But over that same time period, the typical U.S. stock (as measured by Vanguard’s Total Stock Market Index) averaged a compound annual return of 7.99 percent. That would have turned $10,000 into $21,578.

Emotional fear caused much of the gap between the stock market’s performance and the average investors’ performance in U.S. stocks. Less volatile portfolios (those that included bonds) would have been far less frightening than those devoted entirely to stocks. As a result, investors in more diversified portfolios respond less foolishly when stocks fall.

Over 30 year-year periods, portfolios with 100 percent stocks typically trounce portfolios with 60 percent stocks and 40 percent bonds. But we don’t live in a petri dish that’s void of emotion. That’s why smart investors maintain diversified portfolios. They don’t pay attention to bond market interest rates. They don’t pay attention to stock market movements. They ignore economic forecasts and goofy horoscopes.

You might have the courage to stomach big declines. If that’s the case, build an assertive or aggressive portfolio with a low bond allocation. Your Thor-like resolve will help you make a lot of money. But if you don’t see an Action Hero when you look into the mirror, be honest with yourself.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.