Andrew Hallam

19.12.23

Why The FIRE Movement Began And Is Gaining Steam

_

Each year, I asked my high school students to write a 600-word narrative essay. The working title was, ‘Epitomizing America.’”

A narrative essay is basically a story. I wanted the students to “become” a character that, in their eyes, epitomized American life. I had given them a variety of books, short stories and essays to read. Each of those published pieces showcased various American lives. As a result, my students’ stories were as varied as the country.

Some of my students portrayed victims of racial injustice. Others depicted themselves as minimum wage workers, struggling to get by. Others, still, lived luxurious lives in New York or Boston: recipients of old money. Some took the role of an immigrant who made it big with the American Dream.

There is no “typical American.”

Nor is there a typical Asian, typical European or typical Middle Easterner.

We know that spending habits also vary wildly with income. But even among people in similar income brackets, the wealth differences between spenders and investors are opposing Grand Canyon rims.

The reason for that is simple. We have more choices. That’s a result of global, economic progress. In fact, “normal” spending habits for us might make our grandparents cringe.

You need a new kitchen? What does that even mean? Your stove works.Your fridge works. The drawers all work and the sink doesn’t leak. Have you lost your mind?”

“Why did you buy such a large home? Are you planning to let the rooms to boarders?”

“Why are you getting a new car? Your car still works, and it doesn’t break down.”

“Why do you have so many clothes? Do you plan to open a shop?”

Many of us blur our wants with our needs…because we can. We have more money. And in most developed countries, consumer debt, as a percentage of income, has never been higher.

But a growing number of people laugh at this consumption. They don’t buy what they don’t need. They value experiences over things. Many have embraced the FIRE movement: investing heavily for their future to gain financial independence.

The FIRE movement didn’t happen overnight. The seeds took root more than 100 years ago.

I grew up playing with the children across the street. In 1984, when I was 14, their parents retired. Harry and Shoko were in their mid-40s. They worked hard. They were frugal, and they invested well. They also built their lives on the back of progress that began more than 100 years before.

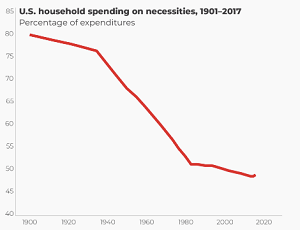

In the 1920s, the typical American spent more than 60 percent of their income just to keep themselves alive: on groceries; clothing; household furnishing; medicine and housing utilities. Wages were low, and the cost of living, relatively high.

By 1975, the typical American required just 45 percent of their income to cover necessities. By 2015, that dropped to less than 35 percent. Other developed countries mirrored these stats.

HumanProgress.org, using data from the Bureau of Economic Analysis

Get International Investing insights

in your inbox once per month

What we did with that surplus was entirely up to us. Most of us ramped up our lifestyles, believing we “needed” better things.

Others learned they could pay down their mortgages, invest, and buy freedom and experiences.

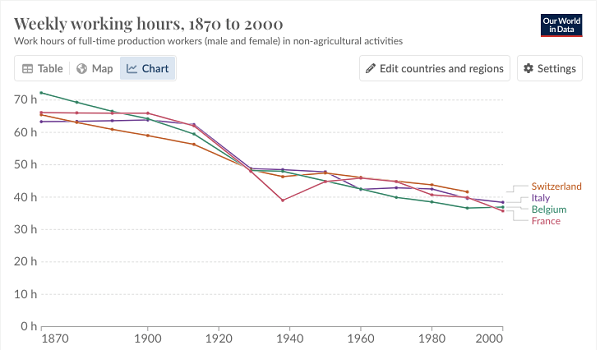

Steven Pinker is a psychology professor at Harvard. In his book, Enlightenment Now, he noted that in 1870 the average worker in Western Europe worked 66 hours a week. The average American worked 62 hours a week and the average Belgian worked a whopping 72 hours a week.

Over the following decades, people worked increasingly fewer hours…simply because they could. Economic progress saw to that. Today, the average Western European works 37 hours per week.

Source: Max Roser, Our World In Data

We don’t really need the US Bureau of Economic Research1 to tell us that leisure time has never been higher. But the research backs that up.

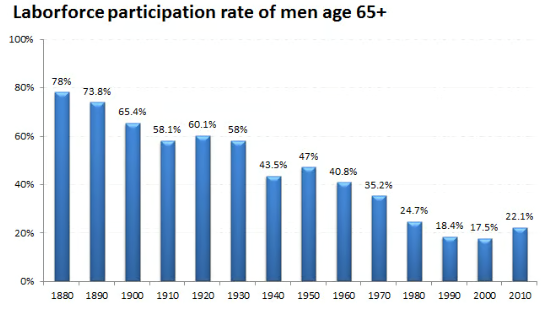

The average hair stylist, garbage collector, mechanic, doctor and [fill in your profession here] retires earlier now than they did in the past. For example, 78 percent of American men above the age of 65 were working fulltime in 1870. That percentage dropped to 47 percent in 1950; 40.8 percent in 1960; 35.2 percent in 1970 to just 22.1 percent in 2010.

You’ll see similar statistics for other developed nations. And the number of nations considered “developed” keeps growing by the decade.

Source: Morgan Housel, using data from the Bureau of Labor Statistics

In the 1980s, more people began retiring in their 40s and 50s than we had ever seen before. Inspired people asked, “How are you pulling that off?” Strategies were shared, and the movement grew.

It gained more followers with the stock market boom. Over rolling, historical 30-year periods, stocks have increased by 8 to 11 percent per year. But from January 1982 to January 2000, global stocks averaged 15.02 percent.

That purchased freedom for those who bought fewer things…and invested.

By the early 1990s, books like Your Money & Your Life inspired even more people to spend less and live better.

Such books aren’t new. I saw one from the 1920s. But soaring markets in the 1990s encouraged your teachers, your dentists and mechanics to read and learn from them.

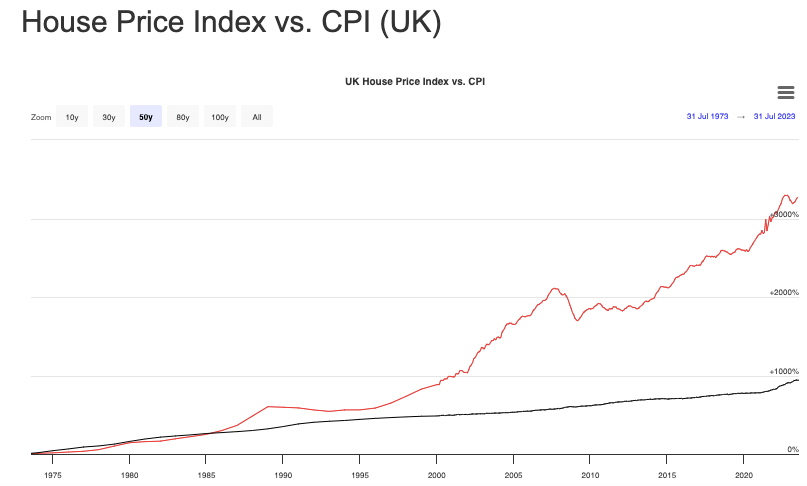

During this time, global real estate also surged. Historically, that was new. In the past, real estate prices (shown in red, below) simply matched inflation. Below, you can see the Case-Shiller Index, representing British homes. Before 1975, and from 1975 to 1985, the prices of British homes matched inflation (shown in black). But not long after, prices began to soar.

Source: Cape-Shiller Real Home Price Index

Yes, wealthy people grew wealthier, as stocks and property prices rose. But for the first time in history, reams of middle class people built wealth, too.

In a quest for wealth and, in many cases, financial independence, they embraced thrift. They invested in the stock market. They bought second homes. Tenants paid their mortgages. Second homeowners rapidly built wealth.

Many retired early. They had money to invest because they spent less.

While their neighbours bought new cars, they bought used. While their neighbours renovated bedrooms, bathrooms and living rooms, they maintained what they had. When they got promoted, they didn’t buy more things.

Instead, they invested more.

When the Internet arrived, everyone could learn. Bloggers such as Mr. Money Mustache and Financial Samurai took center stage. The FIRE movement, before it was even called that, spread like blazing brush.

Then in 2020, COVID 19 hit.

Millions of people were suddenly out of work.

Those without a safety net began to struggle. Plenty of others, who had savings or support, got an unplanned taste of early retirement.

They also had time to reflect.

Priorities for many, changed.

As a result, the FIRE movement surged again.

Wellness-oriented finance books hit bookstore shelves. They included Quit Like A Millionaire, Psychology of Money and Balance, How To Invest and Spend for Happiness Wealth and Health.

“Stuff” took a back seat to time, experiences and happiness.

Unfortunately, consumer debt is still near an all-time high. Plenty of people (even high income people) are living month-to-month.

But the financial independence movement is alive and well.

My students learned that a single culture couldn’t “epitomize America.”

Nor can a single spending culture (or the FIRE movement) epitomize what “people do.”

But more people are aware that relationships and experiences trump non-essential “stuff.” That’s why this movement has room to run.

Economic progress laid the seeds.

Now the people keep it going.

Source

1. https://www.nber.org/system/files/working_papers/w12082/w12082.pdf

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.