Andrew Hallam

15.04.22

Why Berkshire Hathaway Shares Are Soaring This Year

_

The stock market is, so far, stumbling in 2022. From January 1 to April 14th, the S&P 500 is down about 7.4 percent. Some of the best performers over the past few years have taken heavy hits. Facebook shares are down about 38 percent. Netflix shares have plunged almost 44 percent. Even Amazon dropped 9 percent.

In sharp contrast, Warren Buffett’s Berkshire Hathaway shares are defying gravity. As of April 14th, they were up 20.73 percent year-to date. Over the past 12 months, they were up a whopping 42.58 percent. You might be asking, “Why are shares in Berkshire Hathaway rising and shares in Netflix falling? The answer is simpler than you might think. Stock prices are driven by supply and demand. Simply, the dollar value of the sales transactions for Facebook, Netflix and Amazon shares are higher than the purchase transactions. That’s why those shares have fallen. In contrast, more money is flowing into Berkshire Hathaway shares.

Berkshire Hathaway was an ailing textile manufacturer when Warren Buffett first bought shares in 1965. He began paying about $7.50 per share. Today, those same shares are worth about $529,000. No longer in the textile business, Berkshire Hathaway is predominantly an insurance company. When Buffett receives insurance premiums he puts a conservative amount aside to pay out future insurance claims and invests the remainder of that money in private companies and publically traded stocks.

That means, anyone buying shares of Berkshire Hathaway indirectly ends up owning more than 100 businesses. Buffett doesn’t typically buy businesses that he thinks will one day earn a profit. The private and publically traded companies he buys earn profits now. He likes companies that efficiently earn large sums of cash with relatively low capital investments.

His investment philosophy is documented best in his annual letters to shareholders. Lawrence Cunningham’s book, The Essays of Warren Buffett, thematically compiles The Oracle’s wisdom in a highly readable form. Authors such as Robert Hagstrom, Timothy Vick, Mary Buffett and David Clarke have also written solid books describing Buffett’s methods. His philosophy, in fact, is remarkably consistent. He buys great businesses at reasonable prices.

Until recently, most investors ignored that “reasonable price” component. Much as we did in the 1960s and the late 1990s, we’ve been willing to pay sky-high prices for stocks with relatively low business profits. In other words, we’ve been more attracted to future promises than current earnings. But the tide might be turning. Berkshire’s resurgence might mean more investors are, once again, insisting on paying reasonable prices.

My thesis, however, isn’t pegged to Berkshire alone. Stocks are often categorized as growth stocks or value stocks. A growth stock is one with fast-growing corporate earnings. Netflix is an example. But Netflix’s stock price increased far faster than the company’s corporate profits. In contrast, a company with solid corporate earnings but a relatively low stock price is called a value stock. And much like Berkshire Hathaway, value stocks are once again gaining popularity.

For example, despite a drop in the overall stock market, Vanguard’s US Value Stock ETF (VTV) gained about 1.18 percent from January 1 to April 14th, 2022. In contrast, Vanguard’s US Growth Stock ETF (VUG) plunged 16 percent over the same time period.

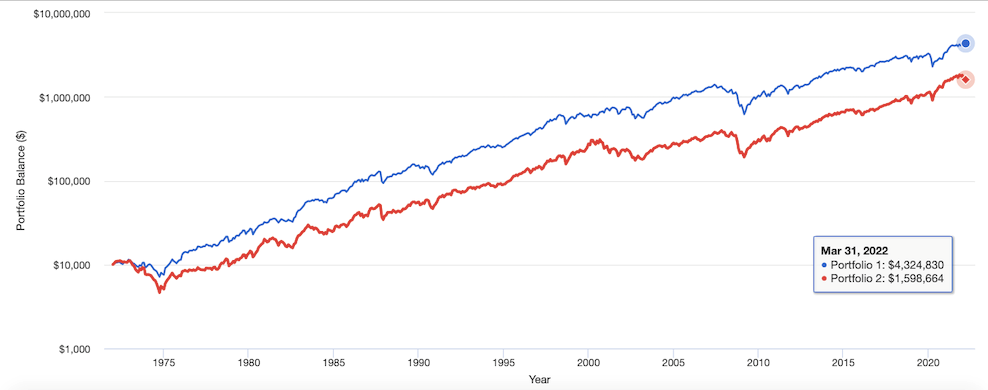

It might look strange to see value stocks winning. After all, these are typically boring stocks. But over long time periods, boring stocks usually beat popular growth stocks. Below, you can see the results of value stocks versus growth stocks from January 1972 until March 31, 2022. The blue line represents a three-way split between US large-cap value stocks, US mid-cap value stocks and US small-cap value stocks. According to portfoliovisualizer.com, over this 51+ year time period, a $10,000 investment in value stocks would have grown to $4,324,830.

If the money were split between US large-cap growth stocks, mid-cap US growth stocks and small-cap US growth stocks, that same $10,000 would have grown to $1,598,664.

Long Term, Value Stocks Beat Growth Stocks January 1972 – March 31, 2022

Source: portfoliovisualizer.com

I’m not saying you should pile everything you own into Berkshire Hathaway or a value stock index. But, if like many others, you’ve shunned diversification to invest only in high-flying growth, it might be time to switch things up.

This isn’t a suggestion to time the market or play musical chairs into a new investment style. After all, I advocate sticking to a single plan through thick and thin. That plan includes exposure to the world’s entire market, not just high-flying growth. If you embrace that strategy, long-term, you’ll be happy that you did.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.