Andrew Hallam

28.07.2021

What's Better, Stocks or Real Estate?

_

In this column, Andrew Hallam discusses the merits and drawbacks of investing in the stock market and real estate. Which is better?

What Would Make More Money, Stocks, or Real Estate?

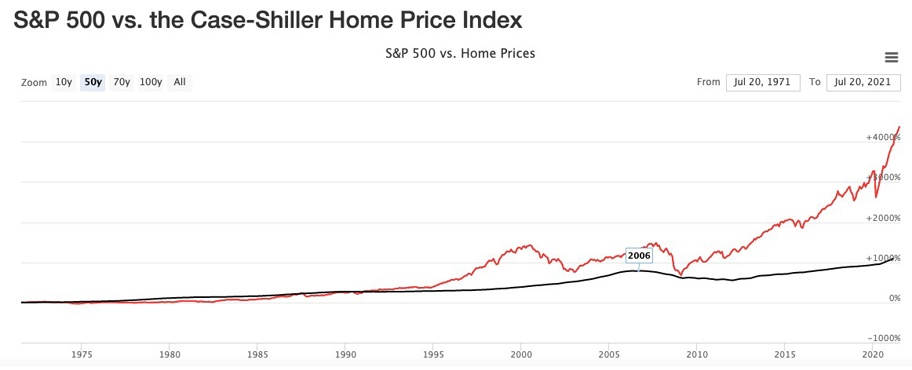

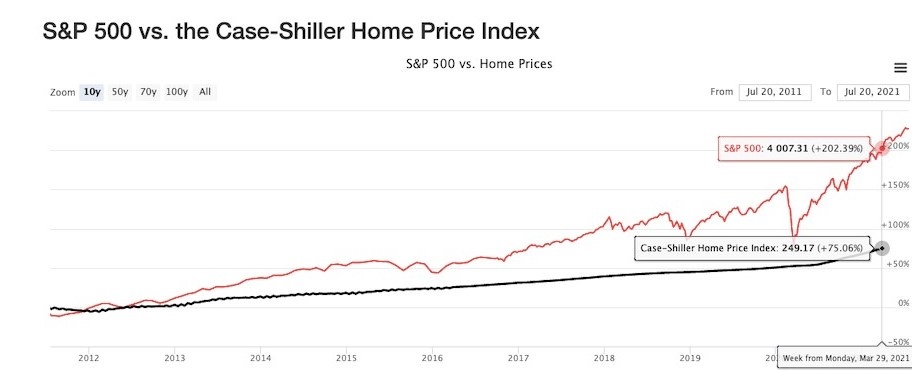

It might be the most common question on investment forums: What’s a better investment, real estate, or stocks? Plenty of stock market zealots scream, “Stocks are better!” They might point to something like the S&P/Case-Shiller US Home Price Index. Over the past 50 years, the S&P 500 increased more than four times higher than the appreciation level of the typical US home.

Even during the past ten years, stocks rose twice as far as US real estate.

Source: https://www.longtermtrends.net/stocks-to-real-estate-ratio/

Several real estate investors, however, might quickly respond. “Real estate is better because you can borrow money to buy it and that rental revenue can cover your mortgage payments.” However, stubborn positions that favor either real estate or stocks don’t prove the supporter’s knowledge or level of sophistication, no matter what charts or graphs might show. Instead, their certainty magnifies a massive blind spot.

OK, so I’ve just insulted leagues of stock market and real estate investors. But in each case, those feeling slighted are forgetting about the law. It isn’t a law (like physics or gravity) but let’s call it a law because it’s a universal truth:

Law of Investment Returns:

No carbon-based life form or computer algorithm can consistently predict future stock or real estate prices.

Plenty of people get paid to try. You might see them on TV. You might read their blogs or listen to their podcasts. They might work for investment banks. But if they were only paid on the accuracy of their predictions, most years, they wouldn’t earn enough to feed themselves.

The question, “Are real estate investments better than stocks?” ignores the fact that income-generating properties are businesses. Much depends on that business’ location, state of repair, maintenance costs, taxes, the rental yield (what the investor paid for the property compared to income earned) and more than a bit of luck.

For example, investors could find a six-unit building in an economically depressed town. Assume the investor pays $500,000 and earns $50,000 a year in gross rental revenue. That’s a 10 percent rental yield. But maintenance costs could dampen those returns. Some of the renters might damage the property, or the resident turnover might be high. The property might earn a high rental yield, but after expenses, vacancy turnover and a high pain-in-the-butt factor, it might not be worth it.

On the flipside, you could find a nice property with reliable tenants who don’t cause much grief. But that investment might offer a far lower rental yield. It might have increased a lot in value, which might be one of the reasons you bought it. After all, forecasters predict that price will just keep rising. That might be the case, but never forget the law:

No carbon-based life form or computer algorithm can consistently predict future stock or real estate prices.

Plenty of American real estate investors paid too much for their properties from 2005-2007, when property soared and were “can’t miss” money-makers. But far too many of those optimistic investors foreclosed on those properties when home prices fell. Their mortgage debts, in many cases, exceeded the home market values.

That same law applies to stocks. Sure, you could have invested $10,000 in Apple’s stock in 2003, seen its value soar to $6.7 million by July 23, 2021, then used the proceeds to buy four or five mortgage-free homes in San Francisco.

Dozens of other stocks also made a fortune. But smart investors don’t look through a rear-view mirror. If they pick the wrong stocks (remember that law) they could lose everything.

That doesn’t mean, however, that stock market and real estate investors can’t put odds in their favor. They can diversify their risk, which could also boost returns. For example, real estate investors should consider properties with more than a single revenue source. In other words, they could buy a two, three or even four-unit home. This way, if one revenue source disappears (a tenant moves or dies) the owner isn’t stuck paying the entire mortgage on her own.

What’s more, even when comparing properties in similar neighborhoods, multi-unit properties will typically have a higher income yield and lower capital maintenance costs relative to income, when compared to single-unit homes. This is why real estate tycoons don’t typically stockpile single-family homes. They often buy multi-units: apartment buildings and commercial buildings with multiple revenue streams.

Similarly, diversification increases safety when investing in the stock market. That’s why, instead of trying to load up on a series of hot stocks (which could turn cold, anytime) we should own the entire market. One of the best ways to do that is to regularly add money to a portfolio of low-cost index funds. By doing so, investors will beat the vast majority of investment professionals, including hedge fund and college endowment fund managers.

There’s no way to know whether real estate or the stock market is going to be better for you. But whatever you do, use common sense and evidence-based principles. As a real estate investor, don’t borrow too much. After all, the urge to be greedy or over-extend often ends with a splat. Stock market investors should also include bonds and rebalance their holdings as needed to maintain a consistent allocation. This will help reduce risk and temper the portfolio’s decline when stocks plunge.

Most importantly, if anyone asks you what is better: real estate or stocks, tell them there are far too many variables to properly consider. Then point to the law that should be taught in every school.

No carbon-based life form or computer algorithm can consistently predict future stock or real estate prices.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.