Andrew Hallam

21.10.2019

Why Expats Often Buy The World’s Worst Financial Products

_

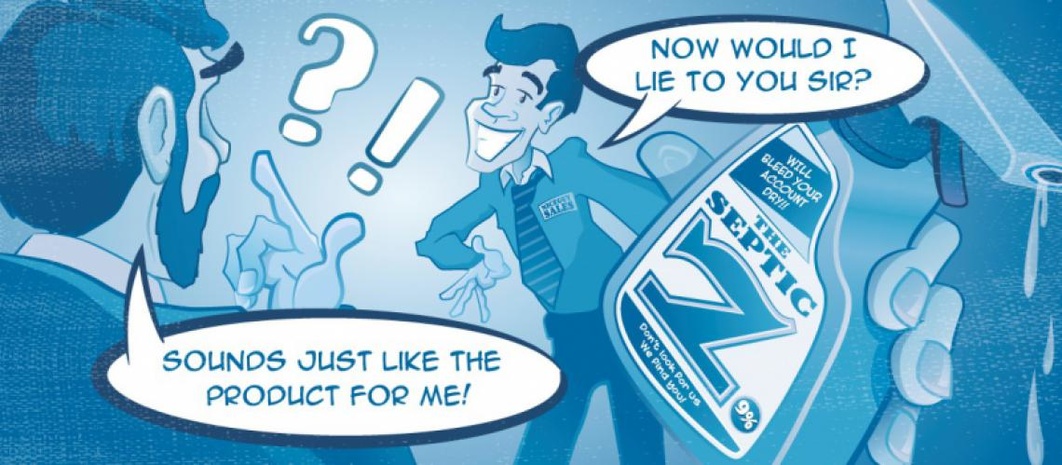

I call them the Septic Seven. They represent seven stinky financial products. Each product charges nosebleed fees…high enough to make cadavers flip.

They’re horrors created by some of the world’s biggest insurance companies. And they slash investors’ hopes. Sadly, if you’re an expat, either you or someone you know is stuck in one of these schemes. They are the most commonly sold products to expats overseas.

Here’s how they usually work. You receive a cold-call from a financial advisor. He (it’s almost always a man) promises to earn you decent profits. He’s charismatic, well dressed, usually good-looking and seemingly very kind. But make no mistake: if anyone tries to sell you a Septic Seven product, that person is either a fool or a snake. There’s a saying in the investment world: good financial products are bought…they are never sold. In other words, if there’s a good financial product, it won’t find you. Instead, you need to find it.

If you’ve invested in a Septic Seven product, the money you contribute for the first 18 months will cost you about 9 percent per year. That money bleeds 9 percent annually for the duration of your term. Money that investors contribute after the first 18 months will attract annual fees of about 4 percent per year. If global markets make 7 percent, and if investors pay 4 percent in fees, investors are giving up 57 percent of their potential profits to fees. If inflation averages 3 percent, such investors make nothing.

How do you know if you own a Septic Seven product? Your investment contributions will be called, “premiums.” You will also be locked in for as long as 25 years. If you try to withdraw money before a designated term is up, you’ll pay a massive penalty. Such products shouldn’t be legal… anywhere.

The silver tongues that push these things say nothing of the fees or the redemption penalties. They get paid huge sums for pushing poor products. Some make more than $1 million a year in commissions. For example, if someone committed to invest $2000 a month for 25 years, the financial salesperson would earn an upfront commission of about $27,000. Some of that money would go to the salesperson’s brokerage. But the salesperson keeps most of it. Where does that money come from? Investors pay that bill. That’s why, if after 18 months, an investor tries to sell everything they added, the investor won’t get a penny. The redemption penalty covers the salesperson’s commission.

Sky-high commissions make this a really big business. Some consulting firms even produce videos like the 10 Habits of Successful Financial Advisors. But if you check out the highlighted youtube link, you’ll see that none of those habits are concerned with clients’ welfare.

Unfortunately, the funds they select can hurt even more than high fees. I’ve spoken to audiences about these products in several different countries. I’ve asked dozens of investors to send me copies of their accounts. Few of them are invested in globally diversified portfolios. Instead, they’re focused on whatever funds would have helped the advisors make the sale. For example, emerging market funds performed well in the years leading up to 2007. That’s why, when I see a Septic Seven portfolio that began that year, it’s almost always stuffed with emerging market funds.

The salespeople aren’t typically trained to diversify a portfolio. Instead, they just focus on how to make a sale. As a result, they often impress would-be victims with past performance charts. They might coo, “These are the funds that I’ll buy for you.” But diversification is the only sensible strategy. One decade’s winners can become the next decade’s loser. For example, emerging market stocks still haven’t recovered from their 2007 high. That’s one of the reasons most Septic Seven investors (who began in 2007) haven’t made a profit.

Yet, measured in U.S. dollars, the global stock market index has risen 97 percent since its 2007 high, as of October 1, 2019. Global stocks are up 200 percent since 2009. They’re up 97 percent since 2011 and up 37 percent since 2015.

In other words, the rising global tide should have risen all boats. Unfortunately, most Septic Seven schemes are sinking or they’ve crashed onto rocks.

If someone began a Septic Seven scheme in 2010 or 2011, I say, “Let me guess what’s in your account.” The price of oil was high then. Gold had recently had a really solid run. That’s why most of these accounts contain huge exposure to natural resource funds and gold. Both sectors fell hard in the few years that followed.

High fees slash away one investment leg. A lack of diversification chops off the other.

So, what are the Septic Seven sales teams pushing right now? As always, they’re looking through the rearview mirror. U.S. growth stocks have had the strongest recent run. That’s why such salespeople are filling new client portfolios with U.S. stock funds. Most of them aren’t bothering with international funds. They’re shunning emerging market funds. They almost never add bonds.

This doesn’t mean U.S. stocks will tank. But there’s a lesson to be learned. Build a diversified portfolio of low-cost ETFs. Include U.S. stocks, international stocks and bonds. Forget about predictions, silver tongues and temptations from the past. Every sector has its years in the sun. And its time in the shadows. Diversify. Don’t mess around.

And always say no to fools and snakes in suits.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.