Andrew Hallam

16.12.22

Should You Move Money Into Gold During Turbulent Times?

_

Sarah is nervous. The stock and bond markets have been leaping around like a sugar-jacked kid on a pogo stick. Stocks plunged in early summer. They recovered some a few months later. But then they plunged again. And because bonds dropped too, Sarah’s globally diversified portfolio of index funds is down about 14 percent for the year, to November 28, 2022.

As Sarah was leaving work for the day, she began speaking with her colleague Jim. “I’m worried about the markets,” she said.

“I get it,” replied Jim. “I just sold everything and put my money in gold. It’s so much more stable than the stock market. With gold, you’re not going to lose your shirt.”

That made sense to Sarah. And she had heard that before. But she wasn’t sure.

She wanted to speak, in person, to her wise friend, Claire. Sarah would have to park her car at the end of a long dirt road and then hike 2 kilometers to the top of a wooded hill.

Claire previously worked at a Wall Street investment firm. But she didn’t like the smoke and mirror tactics that her firm employed. So she quit her job, moved as far away from Wall Street as she could, built a log cabin and managed money for several high-net worth clients: building them diversified portfolios of low-cost index funds.

When Sarah trudged to the edge of Claire’s property, she saw the now-bohemian advisor picking strawberries in her garden. They brought the fruit inside, made a couple of delicious smoothies, and then sat on swinging chairs on Claire’s back porch.

“I’m thinking of moving everything into gold,” Sarah said, after sipping from her drink. “At least, until the markets stabilize.”

Get International Investing insights

in your inbox once per month

Claire always had a Socratic way of engaging in finance-related talk.

“Why do you feel that would be better?” Claire asked.

“Well, everyone knows gold is more stable than stocks.”

“Sarah, how do you think ‘everyone’ came to that conclusion? Did they bother to look it up, or are they just parroting other people?”

“Well, it’s common knowledge, right?” Sarah asks, with doubt creeping in.

Claire begins to smile. Then she laughs.

Sarah, people are so lazy. Most financial journalists are, too. That’s probably why so many don’t have a clue. Gold is actually much more volatile than stocks.”

“No way!” Sarah says, spilling some smoothie on her lap.

“Sarah, let’s compare stocks, bonds and gold over your lifetime. Since 1977, US stocks have had 10 losing years. Intermediate US government bonds have had 6 losing years. How many calendar-year losses has gold experienced?

“Well,” Sarah says, “I would guess five or six. But they were probably small losses.”

Claire smiles again. “Gold has experienced 19 calendar year declines since 1977. US stocks, by comparison, had just 10 calendar year declines.

Sarah wrinkles her face. “But gold’s drops must have been minor, right?”

“No, they were more like Stephen King horror movies. Almost half of those plunges fell 10 percent or more.”

Claire opens her laptop to show Sarah.

“Gold cratered -32.6 percent in 1981. I call that year, The Shining.”

“The years 1983, 1984, 1988, 1997, 2013 and 2015 were almost as horrific. Gold plunged -16.31 percent, -19.38 percent, -15.26 percent, -21.41 percent and -28.33 percent respectively. And from January 1st to November 1st, 2022, gold slipped 11.14 percent.”

Sarah looks like she just found a worm in her smoothie.

“So much for stability, right?” says Claire.

Gold Is More Volatile Than Stocks and Bonds

January 1977 – November 1, 2022

| Gold | US Stocks | US Intermediate Government Bonds | |

|---|---|---|---|

Number of losing years | 19 | 10 | 6 |

|

|

|

|

Years with double-digit losses | 8 | 6

| 1

|

$10,000 Invested Would Have Grown To | $112,326 | $1,197,212 | $168,489 |

Source: portfoliovisualizer.com

“I had no idea!” exclaimed Sarah. But if stocks fall, shouldn’t we jump into gold then? That’s what everybody says.”

“Ah, there’s that ‘everybody’ again,” Sarah.

“This is one of the most amusing parts about human behaviour. Gold sometimes rises during years when stocks fall.

Sometimes.

But at your next New Year’s Eve party, you won’t get a text from God saying, “Stocks shall fall over the next 12 months. Buy gold child. For it will rise.”

Turning Socratic again, Claire asks, “Do you know when most people start recommending gold?”

Sarah thinks for a minute. “Maybe they do it after stocks fall.”

“Exactly!” says Claire.

“I joke that gold is like a diaper. People buy it when their scared enough to poop their beds. Do you recall 2008? Gold seemed to be on everyone’s lips after US stocks fell 37 percent during the financial crisis. What’s more, even while stocks began to recover, many people still pined for gold. Experts on television talked about a cyclical Bear Market. They said 2010 and beyond would be horrible for stocks.”

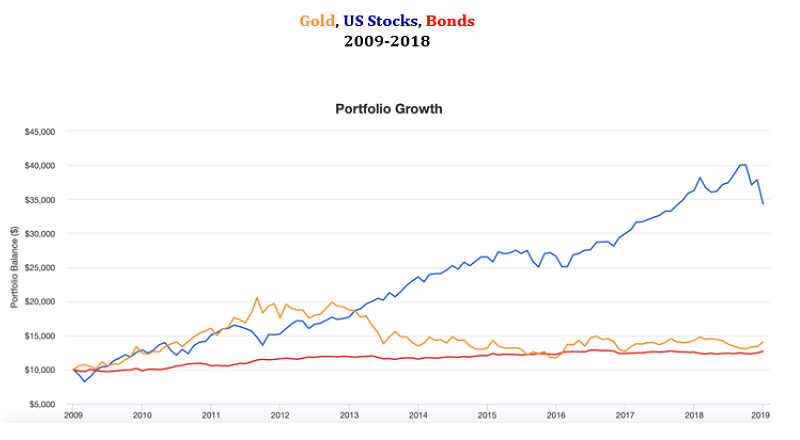

Claire then showed Sarah a chart showing gold, US stocks and US bonds from 2009-2018.

“Anyone who jumped into gold after giving up on a diversified portfolio of stocks and bonds missed out on a lot of money,” said Claire. “That’s what happens, eventually, when people succumb to fear, greed and market forecasts.”

From 2009-2018, US stocks soared about 250 percent. As shown below, gold briefly kept pace, before dropping heavily and remaining in the ditch.

In 2009, Many People Wanted Gold

Source: portfoliovisualizer.com

Feeling better, Sarah promised Claire that she would stay the course. She would keep adding money to her diversified portfolio of index funds. She would ignore what Claire called, ‘primitive urges’ to mess with her money.

Unfortunately, primitive urges and short term thinking, far too often, trump logic, empirical evidence and the best-laid plans.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.