Andrew Hallam

30.05.23

How Do We Convince People That The US Dollar Will Crash?

_

Joey Practicalis had come a long way from his days of studying Journalism at Yale University. He now worked for a global media firm.

He walked into his boss’ office and sank into an old leather chair beneath the room’s only window.

Jimmy Goad strolled in a few seconds later, fresh from his latest smoke break. “Joey, he said, “I’d like you to write about the demise of the US dollar. We write about that every few years and it’s always a hit with readers.”

Mr. Goad’s media firm understood that “hits” were often derived from the ability to spread fear. Several years ago, McGill University’s researchers confirmed that negative news stories attract the most attention. That’s why most news networks pump scary news.

Increased viewership boosts advertising revenue.

“I know this firm has published dozens of stories over the years about the dollar’s demise,” says Joey. “But in each case, they caught attention because the dollar really had been hammered. This time, the US dollar has gained ground on almost every world currency over the past ten years.”

Ten Years Of Dollar Gains Against Most Global Currencies

April 15, 2003 – April 15, 2023

| Currency | Price to buy 1 USD 4/15/13 | Price to buy 1 USD 4/15/23 | US Dollar Gain |

|---|---|---|---|

Chinese Yuan | 6.18 | 6.87 | +11.16% |

Euro | 0.77 | 0.90 | +16.88% |

British Pound | 0.65 | 0.80 | +23% |

Australian Dollar | 0.97 | 1.49 | +53% |

Russian Ruble | 31.60 | 82.28 | +160% |

Swiss Franc | 0.94 | 0.89 | -5.4% |

Canadian Dollar | 1.08 | 1.35 | +25% |

Japanese Yen | 97.53 | 133.83 | +37.2% |

Source: https://www.ofx.com/en-us/forex-news/historical-exchange-rates/

“Joey, you’re being naïve. We’ll publish this story on a month or quarter when the dollar has dipped. Do you remember what the Chairman and editor-in-chief of Forbes magazine, Steve Forbes, said?”

‘You make more money selling advice than following it. It’s one of the things we count on in the magazine business – along with the short memory of our readers.’

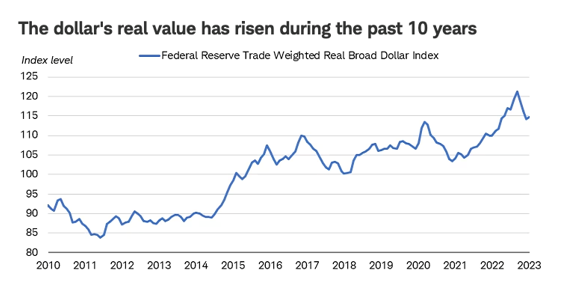

“Mr. Goad, I’m being serious. Based on the Federal Reserve Trade Weighted data, the US dollar has dramatically increased in value compared to the aggregate of the world’s currencies. Here’s a chart created by Bloomberg.

Get International Investing insights

in your inbox once per month

Source: Bloomberg, monthly data as of 2/28/2023.

“Come on son,” laughed Goad. “It’s all about the story. We’ll hit readers with this five-pronged fork.”

1. US sanctions on Russia’s reserves might lead other countries to put their reserves in other currencies.

2. China is beginning to use the Yuan in some of their commodity trades.

3. Brazil and Argentina are talking about merging their currencies into one.

4. Bitcoin will replace the US dollar as the world’s most common reserve currency.

5. As the dollar plunges, we’ll hint that investors could lose money.

Joey furrowed his brow and looked across at Mr. Goad. “People won’t believe this,” he said. “So many countries keep US dollars as their reserve currency because the size and openness of the US market is tough to match. What other currency could take over?”

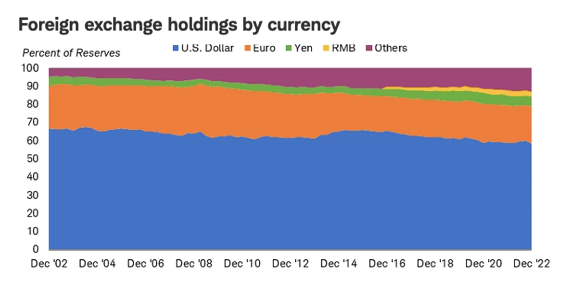

“This isn’t about promoting facts and data,” Goad smirks. “It’s about spinning a scary story. If you want to use data, let’s tell readers that 20 years ago, the US dollar cash reserves comprised almost 67 percent of the currency holdings in foreign banks. Today, it’s down to about 61 percent.”

Mr. Goad got up from his chair and reached behind a large goat he had shot and stuffed back in the late 1990s. He grabbed a huge coloured poster behind the goat. It showed the cash reserves held by foreign country banks between 2002 and 2022. The most dominant colour was blue: US dollar-held reserves.

Source: Bloomberg, quarterly data as of 12/30/2022.

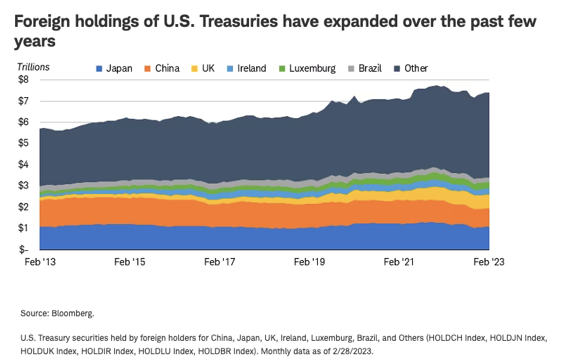

Joey looked carefully at the chart. “It doesn’t look like any other individual currency is threatening US dominance,” he said. “That’s why I still don’t think we’ll convince people. Besides, over the past decade, foreign governments have increased their investments in US government bonds. They wouldn’t have done that if they didn’t have faith in the US dollar.”

Joey was even less convinced by Goad’s next smokescreen. “Do you really think we can convince people that if Argentina and Brazil merge currencies it will threaten the dominance of the US Dollar?”

“Why not?” replied Goad. “We won’t tell people that the US dollar has gained 4000 percent against the Argentinian peso and about 149 percent over the Brazilian Real over the past ten years [measured to April 15, 2023]. So we might convince several people that a merger is a threat.”

Joey Practicalis exhaled and said, “OK, but how do we spin the Bitcoin thing? I don’t know anyone who even knows anyone who has bought anything with Bitcoin. And countries choose reserve currencies based on relative stability. Bitcoin is about as stable as a junkie on a tightrope. Over the past seventeen months, it has dropped about 50 percent.”

“Come on Joey. We can’t mention that. We also want people to think that if the US dollar drops, any US priced investments will fall hard with it. We can’t tell people that one of the biggest US dollar drops of all time started in 2002…and that 15 years later, US stocks had more than tripled in value.”

The US Dollar Fell Hard Against The World’s Major Currencies

February 2002 – July 2011

| Currency | February 2002 Price to buy 1 USD | July 2011 Price to buy 1 USD 4/15/23 | US Dollar Drop |

|---|---|---|---|

Chinese Yuan | 8.27 | 6.37 | -23% |

Euro | 1.14 | 0.70 | -39% |

British Pound | 0.70 | 0.62 | -12% |

Australian Dollar | 1.95 | 0.92 | -52% |

Swiss Franc | 1.69 | 0.81 | -52% |

Canadian Dollar | 1.59 | 0.96 | -40% |

Japanese Yen | 1.32 | 80.06 | -39% |

Source: https://www.ofx.com/en-us/forex-news/historical-exchange-rates/

“I own a global stock market index that’s priced in US dollars,” says Joey. “Do you think I can convince people that this is an investment in US dollars?”

“By golly, I think you could pull that off! But we shouldn’t specifically say that because we know it isn’t true. An investment in a global stock market index is an investment in the world’s stocks and the world’s currencies, even if the index is priced in USD.”

Goad laughed and added: “Here’s something else we wouldn’t want to write: If the US dollar fell 50 percent over the next ten years against a basket of foreign currencies, and if an international stock market index were flat for that decade, that international index would show a 100 percent increase, measured in USD.”

“That’s so true,” Joey smiled. “And here’s something else. A plunging US dollar would actually be good for many US businesses.”

“How so?” asked Mr. Goad, leaning forward with interest.

“Well, many US companies earn huge portions of their revenue in foreign currencies. For example, about 70 percent of Coca Cola’s revenue comes from non-US dollars. When the US dollar falls, that boosts Coke’s revenue, when measured in USD. That can boost Coke’s share price. Other big US firms, from Apple to Johnson & Johnson can also benefit when the US dollar falls because much of their revenue is derived from non-US dollars.”

“Don’t you dare write that.”

“No, Mr. Goad, I definitely won’t.”

All this thinking got Joey pondering his own money. He was so happy that his portfolio of index funds was globally diversified. Whether the US dollar fell or not wouldn’t matter because Joey’s portfolio comprised stocks in every major global currency.

And Joey’s mischievous side was warming to the idea of this story: the demise of the US dollar.

“I really think we can pull this off,” Joey said.

“Finally!” laughed Mr. Goad. If you didn’t agree to write it, I was going to fire you today and suggest you teach economics and finance at a university instead. We’re not in the business of educating people, Joey.”

“No sir. I guess we aren’t.”

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.