Andrew Hallam

10.02.2021

Don’t Turn Your Back On Diversification Now

_

If you watched the 2004 movie, Million Dollar Baby, you might remember a chilling scene. Boxer, Maggie Fitzgerald (played by Hilary Swank), is fighting for the WBA Women’s Welterweight Championships against Billie Osterman, an ex-prostitute known for her dirty tactics. Fitzgerald’s trainer, Frankie Dunn (Clint Eastwood) warned his fighter to always keep an eye on her opponent…and not turn her back.

But after the bell rings to end a round that Fitzgerald clearly won, she turns away from her frustrated German opponent. Billie Osterman then hits her from behind. Maggie falls forward, smashes her head on a chair and becomes a quadriplegic.

Recency bias led to Maggie’s downfall. It’s a cognitive bias where people form expectations about the future, based on the recent past. In previous bouts, nobody hit Maggie from behind, so on a conscious (or subconscious) level, she didn’t expect it to happen. And when it did, she paid a far too heavy price.

Recency bias affects investors, too. It starts slowly enough, but it gains momentum quickly. Consider the mid 1990s. Investors watched, with curiosity, as technology stocks took flight. By the late 1990s, FOMO (Fear Of Missing Out) drove plenty of, otherwise responsible, investors to abandon diversification in favor of the new paradigm. The sector was on fire, and people believed the party would continue.

But the stock market is a dangerous seducer, often convincing us to invest more than we should in a current, hot sector. After several years of eye-popping returns, that seducer hit back. Tech stocks crashed.

By 2002, technology investors were badly bruised and battered. At that point, the mischievous market decided to set up other victims. It seduced investors with stories about the world’s fastest growing economies: China, Thailand, Malaysia, India, Brazil and the other emerging markets.

Such countries experienced economic growth at a rate nobody had seen before. In my own short lifetime, I saw cities with few paved roads, low-rise buildings and low standards of living transform themselves into futuristic symbols (Beijing and Shanghai come to mind) that made North America’s modern cities look like relics.

Developed market economies had snail-like GDP growth, compared to fast-growing economies like China. Investing in this growth seemed like a no-brainer. And market returns said those instincts were right.

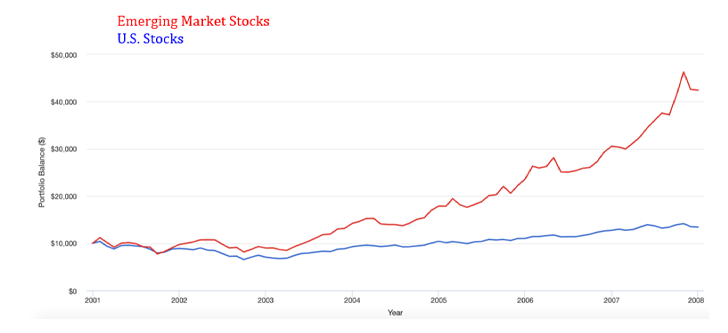

From January 2001 to December 31, 2007, emerging market shares averaged a staggering 22.93 percent per year. That would have turned a $10,000 investment into $42,423, quadrupling over just seven years.

Over the same time period, American stocks averaged a paltry 4.3 percent per year. The emerging market promise made so much sense. Consequently, many people built lopsided portfolios to focus on this sector. But once again, recency bias set them up to get knocked out.

Emerging Market Stocks Leave U.S. Stocks Behind

2001-2007

Source: portfoliovisualizer.com

This makes investing so darn hard. When tempted with the next, hot sector, we often fall into traps. We tell ourselves that five or ten years of outstanding performance indicate a new paradigm, a clear signal representing more of what’s to come.

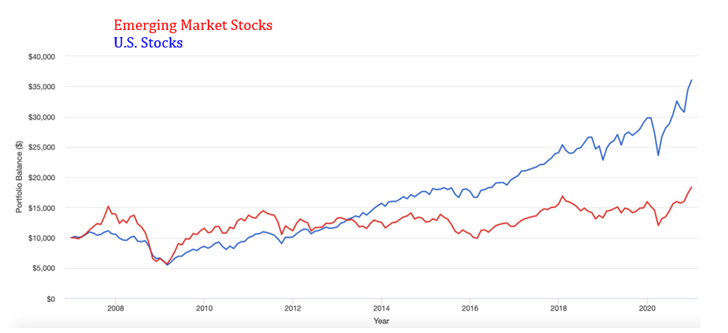

But like technology stocks before them, emerging markets fell hard. Their economies continued to record high GDP growth. But their stocks tread water for almost 14 years.

Stocks From The World’s Fastest Growing Economies

Fall Behind U.S. Stocks

2007-2021

Source: portfoliovisualizer.com

And what about today? Recency bias has convinced new investors (and those with bad memories) that U.S. stocks will keep winning. Many now shun international shares. What’s worse, the seductive power of the market says technology stocks, once again, will beat the returns of everything else.

But to boost our odds of long-term profits, we shouldn’t overweight or turn our backs on any asset class or region. Diversification is a time-tested premise. If we build a globally diversified portfolio of low-cost index funds we’ll own pieces of every sector in the world. We should maintain a consistent allocation and not get seduced by stories, predictions or recent winners. After all, we should aim for long-term profits, and avoid getting our own heads smashed against a chair.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.