Andrew Hallam

05.03.24

Do I Regret Selling My Berkshire Hathaway Shares? They Would Be Worth Almost $2 Million Today

_

In 2005, The Wall Street Journal published a story titled, Warren Buffett’s Bed & Breakfast. The headline grabbed a few eyeballs. It looked like Mr. Buffett offered a place to sleep, and then dished out stock tips over pancakes.

But the story was about me. I had sent Warren Buffett a postcard. “There aren’t any hostels in Omaha,” I wrote, “so I was wondering if I could sleep in your garage or on your living room sofa.”

Warren Buffett sent the postcard to The Wall Street Journal, and they wrote the story. I flew to Omaha. I met Mr. Buffett, the late Charlie Munger and Bill Gates. Then I flew back home to Singapore.

I also kept buying Berkshire Hathaway shares over the next 7 years. I was–and continue to be–a Warren Buffett fan. At the time, I also owned shares in several other individual stocks. I owned ETFs too.

In 2011, my individual stocks (not including my ETFs) were worth about $700,000. My Berkshire Hathaway shares, alone, were valued at $400,000.

But that year, I sold every individual stock I owned…on the same day. I added the proceeds to my ETFs.

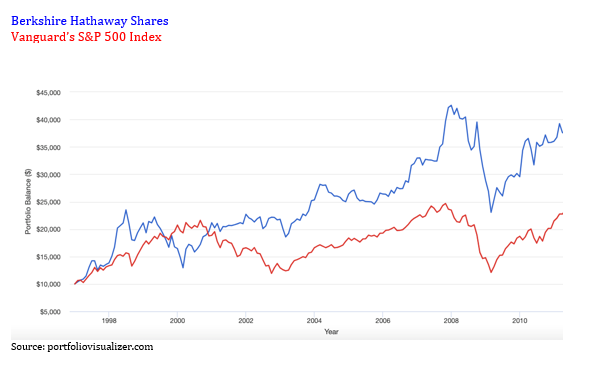

You might think I was disappointed with the performance of my stocks. But I wasn’t. Berkshire Hathaway, itself, made me a lot of money. As a longtime shareholder, I bought Berkshire Hathaway’s B Class shares shortly after their launch in 1996. A $10,000 investment in Mr. Buffett’s company at the beginning of 1997 had nearly quadrupled by March 2011, when I sold those shares.

By comparison, an equal investment in the S&P 500 barely doubled over the same time period. So why did I sell? And what’s more, why did I put the Berkshire proceeds in a US stock ETF? My investment in Berkshire Hathaway, after all, had thumped the index.

The Advantage I Had Over The S&P 500 Index

January 1997 to March 2011

Get International Investing insights

in your inbox once per month

Several years before, I started reading every book I could find about Warren Buffett. I devoured his annual shareholder letters1. I wrote about Mr. Buffett for financial magazines. My bedtime reading was Lawrence Cunningham’s, Essays of Warren Buffett (now in its 8th edition).

I wasn’t a casual fan. I was fanatic.

My oxygen supply was Mr. Buffett’s 1984 essay The Super Investors Of Graham and Doddsville2. It said investors could beat the market if they followed a set of rules.

In 2010 I began research for my book Millionaire Teacher. At the time, my portfolio consisted of individual stocks and ETFs. But the research was clear. Few people beat the market over time. The odds of doing so are about 50-50 over a single year. Over ten years, those odds drop hard. Over 30 years, you’ll have better odds beating a cheetah in a 100-meter race.

I’m not saying it’s impossible. Even a cheetah could pull a muscle. But it isn’t likely. In 1965, when Warren Buffett took Berkshire Hathaway’s reigns, it was difficult (but easier) to beat the market over several decades.

Larry Swedroe and Andrew L. Berkin explained this in their book, The Incredible Shrinking Alpha: And What You Can Do To Escape Its Clutches. Showing their respect for history’s great investors, Swedroe and Berkin wrote:

“They were decades ahead of their time. They learned that you could beat the market by picking small stocks or value stocks or quality stocks with increasing price momentum.”

But today, most active managers know that. Swedroe and Berkin say the market has changed. “Today, professional investors account for as much as 90 percent of stock market trading. And each decade, they get better and more sophisticated.”

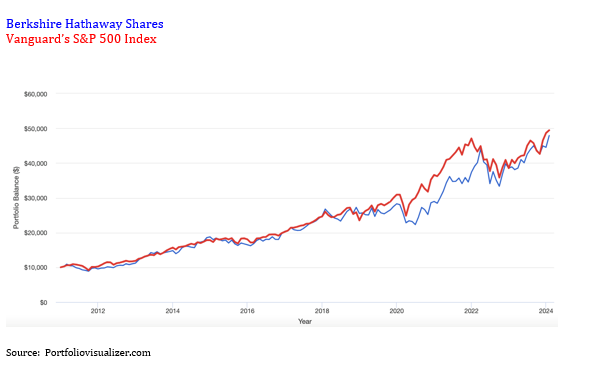

Since I sold my shares in January 2011, Berkshire Hathaway has continued to soar. But as you can see by the image below, my US stock ETF is slightly ahead of Berkshire Hathaway.

Berkshire Hathaway vs. Vanguard’s S&P 500 Index

January 2011 – February 2024

Warren Buffett knows that the odds of finding a stock picker who will beat the market over the next 30 years are lower than a gecko’s belly.

He knows several people who have beaten the market in the past. Some have thumped the market over the past 10-15 years. But he knows that their odds of continuing to win aren’t very good. And the odds of finding someone new (in advance) who can beat the market might be even slimmer.

Warren Buffett’s mind also aligns with his money. When he dies, he has instructed that his estate (on his wife’s behalf) be invested in a portfolio of index funds. This guarantees that his wife’s money will beat the vast majority of professional investors. Smart investing, after all, isn’t about rolling dice. It’s about putting the highest statistical odds in your favour.

I’m 53 years old. I’ve never earned a high income. I was a teacher. But my portfolio has swelled to several million dollars. It’s invested in a globally diversified portfolio of ETFs. No hot stocks. No crypto. No speculation.

You could do the same.

Would Mr. Buffett give his blessing?

Recall the portfolio he has planned for his wife.

That says everything.

Sources

1. Shareholder Letters (berkshirehathaway.com)

2 . The Superinvestors of Graham-and-Doddsville (columbia.edu)

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.