Andrew Hallam

14.11.22

To Benefit From Bonds The Devil Is In The Details

_

My favourite country music song is The Devil Went Down to Georgia, by the Charlie Daniels Band. The devil is behind on his quota for souls. He finds a fiddler named Johnny and offers him a deal. He and Johnny would compete to see who can best play the fiddle. If Johnny plays better than the devil, he wins a golden fiddle. If Johnny loses, the devil gets his soul.

Johnny rocks it, and the devil flees with his tail between his legs. If you’re wondering how this relates to bonds, please bear with me.

In a sequel to the song (I totally made this part up) the devil strolls into a pub filled with Manchester United fans. “I’m going to make you collectively choose one of two options,” he says.

Option 1:

I’ll make every member of Manchester United age 18 years older for the next two seasons. But after that, every player will play at his peak for the following five years.”

Before hearing Option 2, an Old Trafford regular asks, “What do you mean by peak?”

The devil responds, “Consider Cristiano Ronaldo. I’ll make him the age he was in 2014. He was faster, younger, better. That was, or was equal to, his best year ever.”

“And what about Manchester United’s youngest guys?” asks a keen-eyed woman standing beside the pool table.

“I know what future year they’ll peak,” smiles the devil. Three years from now, I’ll put them each at their future best.”

“What’s Option 2?” asks a bald-headed man holdings darts.

“With Option 2, I won’t age your players,” he says. “But Manchester United’s management will trade every player on the team for a batch of guys you haven’t heard of.” To make this sound better, the devil adds, “There might be some great unknowns in South America, Africa and Europe. But choose carefully between Option 1 and Option 2. If Manchester United doesn’t win the league championships at least once during the next six years, I take every one of your souls.”

Option 1 would require patience. But it offers extremely high odds of future success. Each of Manchester United’s players would turn old, right away. Even their youngest players would be in their late 30s. But after two years, they wouldn’t just revert back to the way they were. Instead, they would each play at their prime.

In contrast, Option 2 might (might!) be better, short-term. But it favours the devil.

After getting bested by Johnny the fiddler, old red-face is really hungry to collect those souls.

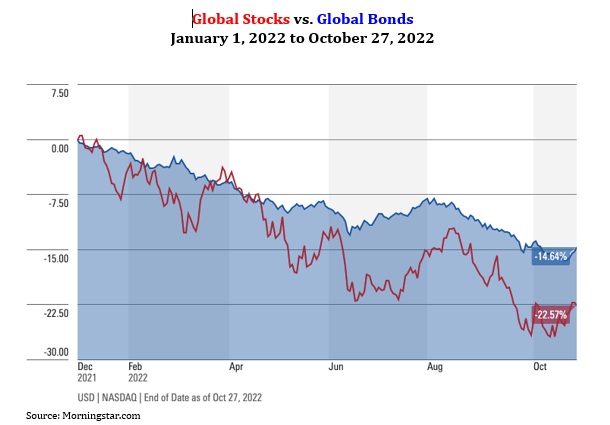

Here’s how Option 1 relates to bond market index funds. In many respects, they’re like professional football players who suddenly aged 18 years. From January 1 to October 27th, 2022, global bonds, as shown below, fell 14.64 percent. Nobody expected that. Stocks fell further. But this was a big drop for bonds.

Here’s what happened.

Bonds were paying a paltry 1 or 2 percent interest rate per year. But when global banks increased interest rates and inflation accelerated, nobody wanted bonds that paid such low rates. Investors dumped those bonds like a really bad date. Their prices then fell, as demand dropped off.

But a bond market index fund is a revolving door of bonds.

For example, each bond within an index has a different maturity date. When a one-year bond expires, a new one-year bond replaces it. Because global banks increased their prime lending rates, that new one-year bond now pays a much higher interest rate. The same thing will happen with two year bonds, three year bonds, and so on. In other words, bond index funds will be in their interest-paying prime, much like the devil promised peak football-playing years.

Unfortunately, most investors aren’t patient. Plenty will metaphorically jump at the devil’s Option 2. They’ll shun bonds for the unknown players. Many will trade into different things with no way to see their future.

That’s why investors in diversified portfolios of stock and bond market index funds should remain loyal to their team. If they have money, they should keep adding more. They should also rebalance their portfolios to maintain a consistent allocation.

The devil might not walk into your local pub or offer you a golden fiddle. But investors who act on fear and greed will likely end up dancing with demons of their own.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.