Andrew Hallam

24.05.24

Are You Confused By So Many Investment Choices?

_

Imagine this. You’re 15 years old. While hiking with your parents in Peru, you scamper off the trail towards a purple lake. You shuffle along its steep edge, lose your footing and fall in.

You don’t feel any different. But that water had power. From that point on, you’re irresistible. The crushes you have at school now compete for your attention. People are following you home (yeah, it’s creepy) like a pack of stray dogs.

As you enter your 20s, you seek an upside: At least you won’t have trouble finding the right life partner.

That’s deluded, of course. Life would be a curse with endless choices and temptations. Unfortunately, this sounds a lot like investing. Every financial stock, scheme, fund and strategy screams your name.

More than 7000 stocks are dancing around out there. Almost 9000 ETFs are vying for your money.

These choices spell trouble.

For example, in the United States, workplace employees are often paid to invest. Yes, you read that right. If Suzy the accountant adds $1000 a month to her company’s 401(k) plan, her employer could chip in another $1000 every month. That’s common.

Suzy could then choose from several funds within the plan. But here’s the rub. If Suzy sees a high number of funds, she’s less likely to invest.

A U.S study1 found that when companies offered the choice of just two funds, 75 percent of their workforce invested. But when employers gave them a bigger menu, fewer people did.

In Barry Schwartz’s book, The Paradox of Choice, he described researchers displaying jars of jams to consumers. In one version, shoppers saw six varieties. In another, there were 24 jams. More options attracted more lookers—but not buyers. The smaller number of jams resulted in ten times the number of purchases.

You might not have a company 401(k). But too many investment choices could cement your own feet. That could be expensive. After all, for every 5 years you delay investing, you’ll have to invest almost twice as much every month.

You might not procrastinate. But a sea of investment choices offers another risk. If we see a “better performing” stock, ETF or strategy, we often leap from our ship to one that’s sailing past.

Get International Investing insights

in your inbox once per month

But fortunes reverse. It isn’t long before our new ship stalls, and the ship we were on sails by again. Research2 suggests that the more we trade, the less money we tend to make.

What’s worse, trying to see the financial future is like training a dog to fly. Research proves that even hedge funds are bulldogs, not birds. And according to the SPIVA Persistence Scorecard3, funds that soar during one time period typically limp the next.

It’s much the same with stock markets.

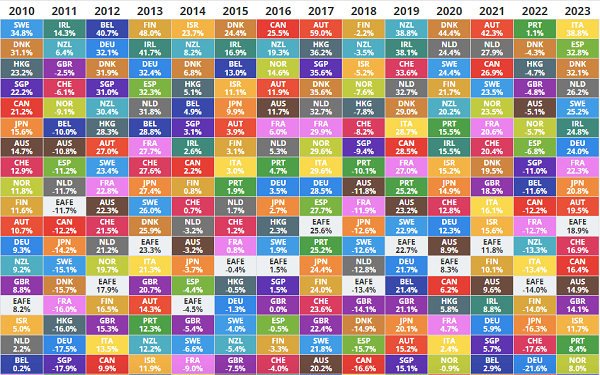

International Stock Market Returns

Source: The Novel Investor

For example, as shown above, Swedish stocks gained 34.8 percent in 2010. That doubled the return of the U.S. stock market. Plenty of people bought the iShares MSCI Sweden ETF4 after seeing those northern lights. But the following year, Sweden went dark.

Irish stocks topped the pops in 2011, gaining 14.6 percent. That was seven times better than the US stock market, which gained about 2 percent. What did people do? You guessed it. Many jumped into the iShares MSCI Ireland ETF5.

Then in 2012, Irish stocks performed like their national bobsled team. If you examine the table above, you’ll see that winners always change.

Instead of trying to chase past winners, ignore the multitude of selections. Build a globally diversified portfolio of ETFs and stick to your plan. This is harder said than done, and it will test your mettle. It’s even tougher if you put faith in a longer-term trend.

For example, the Dow Jones Industrials of US stocks didn’t gain ground from 1965 to 1982. Including reinvested dividends, the S&P 500 did not beat inflation. Over those 17 years, most of the world’s other markets left America in the dust. If you had the choice, would you have left U.S. stocks? Many people would have. But fortunes reversed. From 1982 until 2000, US stocks rocked.

However, by 2011, many people (especially Canadians) wanted no part of the stars and stripes. A $10,000 investment in a US stock index in the year 2000 would have shrank to just $8,530, a full eleven years later (measured in CAD). Meanwhile, the same $10,000 in a Canadian stock index soared almost 100 percent. The emerging markets of developing nations made even more!

At the time, many journalists and financial advisors said we should avoid U.S. stocks. Many gave good reasons that U.S. stocks were dead. They said Canadian stocks and the emerging markets had the brightest future. But over the following ten years, U.S. stocks beat both.

Choices make investing difficult. But it doesn’t have to be. Nobody can consistently pick future winners. That’s why, if we can build a low-cost, globally diversified portfolio, we can win the long-term game. That’s easily done with an all-in-one index or all-in-one ETF. Just set it and forget it. You’ll own the world, all the time.

The question is, will you have the strength to ignore every temporarily passing ship?

Sources

2 Research

Recommended All-In-One Model Portfolios

For Canadian and Australian investors

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.