Small Caps

Small in size but not in strength

Over the long term, small caps perform better than large firms on the stock market. We take a closer look...

By Bertrand Beauté

The performance of stock market giants such as Apple, Tesla or Nestlé is under constant surveillance by the business press and financial analysts. In contrast, thousands of smaller companies, referred to as small caps for their small market capitalisations, are sometimes overlooked.

Globally, small caps represent 80% of listed companies, according to index provider MSCI, but only 14% of total market capitalisation and less than 5% of traded volumes, while large and very large caps represent 6% of listed companies and 80% of total market capitalisation.

However, small does not mean insignificant when it comes to investment "Over the long term, small caps deliver far higher returns than those of large companies on almost all equity markets worldwide," says Raphaël Moreau, Sextant PME fund manager at Amiral Gestion. "Over the last 20 years, small caps have immensely outperformed large caps."

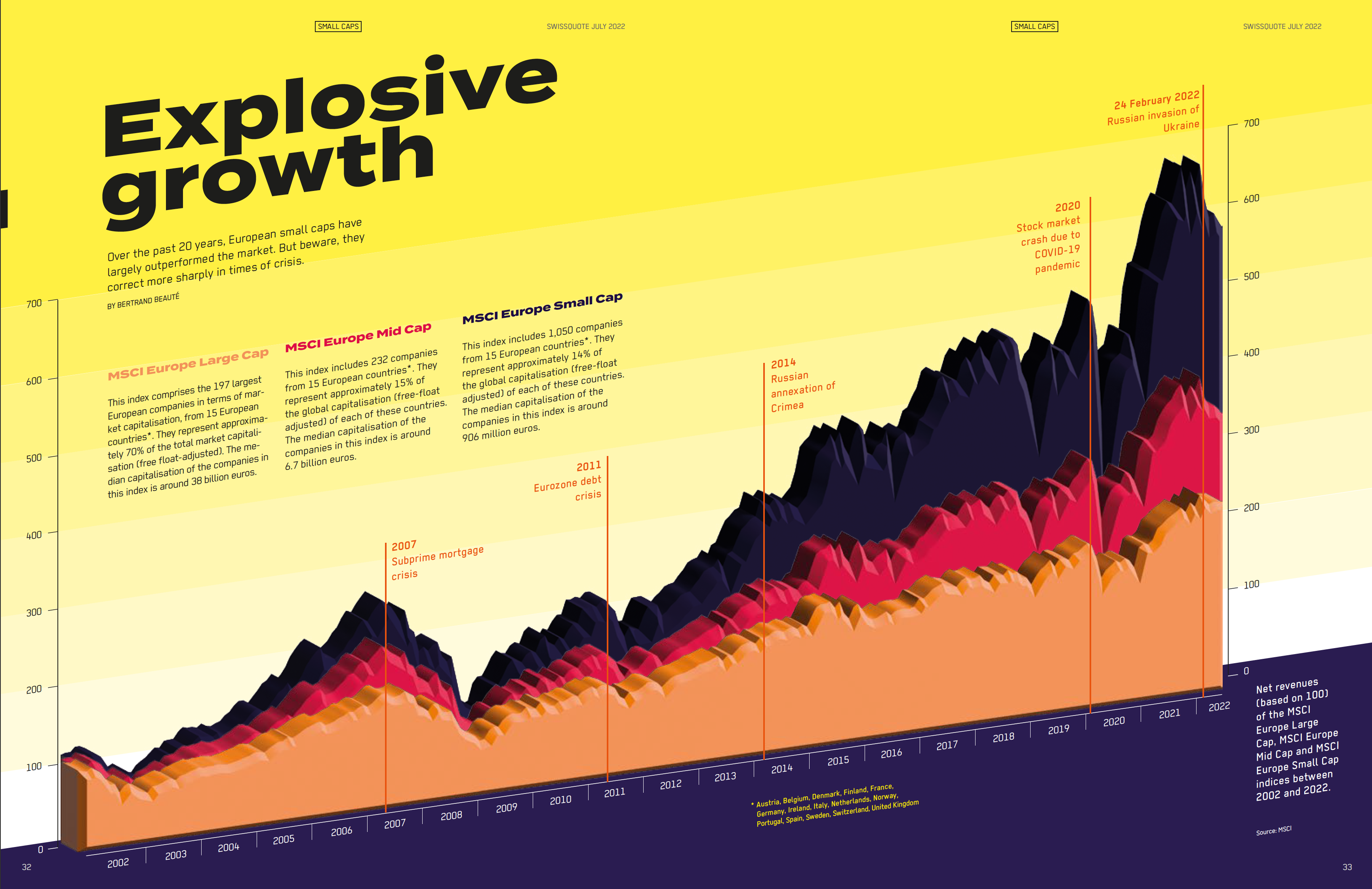

A look at indices can confirm that. The value of Switzerland’s SMI, which includes the country’s 20 largest listed companies, increased almost seven-fold between 1996 and the end of 2021. This is a solid performance, but significantly lower than that of small and medium-sized companies. Over the same period, the SPI Extra – an index that measures the development of small and medium-sized Swiss companies not listed on the Swiss stock exchange – appreciated by a factor of 10. The same is true in the rest of Europe, where the MSCI Europe Small Cap Index has delivered net income growth of more than 500% over the last 20 years, compared with around 200% for the MSCI Europe Large Cap Index.

Why such a huge difference? "Basically, small caps are small companies. It’s easier for a company to double revenue of only a few million dollars than revenue that’s already in the billions," says Bart Geukens, portfolio manager for European small caps with asset management company DPAM. "Small caps grow at a faster rate than large caps." For example, asset manager DNCA Investments estimates that small companies in the MSCI Europe Small Cap Index grew 10% on average between 2019 and 2021, compared to a 2% decline for large and medium-sized companies in the MSCI Europe Index.

"Small cap stocks can be sleeping beauties on the stock market"

François Mollat du Jourdin, chairman and founder of multi-family office MJ&Cie.

Furthermore, the fact that small caps are covered less by analysts and the business press instills hope that there are gems that have remained hidden until now. "Small cap stocks can be sleeping beauties on the stock market," says François Mollat du Jourdin, chairman and founder of the family office MJ&Cie. "Some of these companies are under-valued because the market is not interested in them, despite their growth potential." For instance, the Basel-based pharmaceutical firm Roche is tracked by more than 20 analysts, while the Lausanne-based biotech company AC Immune, which develops treatments for Alzheimer’s and Parkinson’s disease, is only monitored by three experts. This lack of coverage of small companies tends to make their share prices more attractive than those of the stock market giants. "In terms of net assets, small caps are 20% cheaper on average than large caps," Raphaël Moreau says.

But on the stock market, a good deal depends less on purchase price than on growth potential. "When we invest in small caps, we want to unearth the next Logitech," says Guillaume Chieusse, head of Oddo BHF Active Small Cap, with a smile. "We’re looking for a company with little or no analyst coverage that is developing under the radar, but that will grow to become an international giant."

WHAT DEFINES "SMALL"?

Although the term "small cap" is used widely in finance, its exact meaning remains vague. "There is no clear definition for small caps," says François Mollat du Jourdin, chairman and founder of the multi-family office MJ&Cie. "The rules differ according to the financial players." For example, in Europe, companies with a market capitalisation of less than $2 billion are generally considered small caps. Mid-caps are worth between $2 billion and $10 billion in market capitalisation, and large caps are valued at more than $10 billion.

However, this arbitrary classification does not apply to the enormous US market. As valuations can exceed $1 trillion, a $10 billion market capitalisation cannot be classified as a large cap. The Russell 2000 index, a benchmark in the US, defines small caps as the 2,000 smallest US companies by capitalisation. Going with that definition, the average market capitalisation of US small caps was $3.127 billion in April 2022, and the largest was worth more than $15 billion.

But again, that definition is not appropriate for all countries. Some markets, like Switzerland, only have 2,000 listed companies. Another approach is that of index provider MSCI, which has the advantage of applying anywhere. MSCI defines small caps as the smallest companies in a market, which together account for 14% of the total market capitalisation. To illustrate that, the MSCI Europe Small Cap Index comprises 1,050 companies and has an average capitalisation of $1.364 billion, while the MSCI USA Small Cap Index represents 1,933 companies and has an average capitalisation of $2.249 billion.