Andrew Hallam

06.11.2019

The Simple Things I Did To Build Wealth And Happiness

_

I wrote an international bestselling book in 2011. I wanted to call it, The Nine Rules of Wealth You Should Have Learned In School. But the publisher thought that sounded lamer than a Daddy Long Legs spider after a bout with a three year old. Instead, they wanted the cringe-worthy title, Millionaire Teacher.

Yes, I had built a million dollar portfolio on a schoolteacher’s salary. But my parents tried to raise a humble son, so I (and they!) hated the title of that book. That title, however, attracted plenty of attention. I was the first British-born author to have the number 1 bestselling finance book on Amazon Canada and Amazon USA. It became a cult classic in Taiwan. It was translated into several languages, including Thai, Chinese and Korean. At one point, it was the 12th most popular book on Amazon USA, chasing Fifty Shades of Grey.

I followed up with a book for expats: Millionaire Expat, How To Build Wealth Living Overseas. But how did I build that seven-figure sum? No, I didn’t buy baby Bitcoins. Nor did I gamble on a hot tech stock. I didn’t borrow to invest, nor did I inherit any money.

Fortunately, I grew up in Canada, where nobody sells dodgy offshore pensions. I lived far below my means, and I squirreled everything I could into a portfolio of mutual funds and stocks. When I got married, my wife (who was also a teacher) combined her income with mine, and we continued to invest.

But I had the greatest ally: time. I started to invest when I was 19 years old. While I was studying to be a teacher, I worked part-time at a supermarket. During the summers, I washed and fueled buses. Between university classes, I often ran down the street to cut the grass for wealthy people. I didn’t track how much I saved. But here’s the gist of how I made something big from something small.

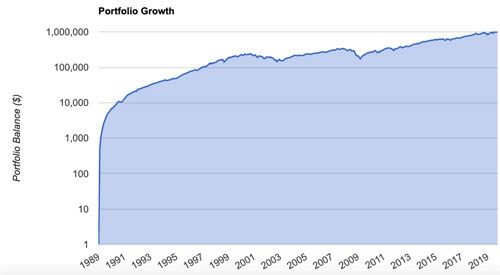

Imagine somebody earning an extra $17.50 a day and putting those proceeds into a stock market index. I started to invest in 1989, so imagine that I applied those savings from January of that year. That $17.50 a day would total about $525 a month. As I began my first serious job, I invested far more than that. But for this example, imagine I stuck to $525 a month.

If it were invested in the S&P 500 index, that $17.50 per day would have grown to more than $1 million by September 2019.

How $17.50 Per Day Grew To A Million Dollars

1989-2019

Source: portfoliovisualizer.com, using Vanguard’s S&P 500 Index (VFINX).

That’s a lot of money. You might wonder, however, what I needed to sacrifice. I once met a guy who said, “Yeah, you have plenty of money now. But you invested everything and didn’t have fun when you were young.” It’s true that I forfeited plenty of material things. For example, I’ve never bought a new car. I’ve never bought the latest iPhone. I don’t wear designer clothes or chase the latest tech gadgets.

But studies show that we don’t need any of those things if we want to be happy. A University of Michigan study proved that people who drive expensive cars don’t enjoy driving their cars more than people who drive lower-range cars. A German study showed that people who upgrade their homes don’t report higher levels of happiness as a result of upgrading their homes. This is based on the “hedonic treadmill.” We might pine for something material, like a new phone or car. But shortly after acquiring it, it becomes just another phone or car. In other words, we get used to it, so it no longer adds pleasure.

In fact, there’s no correlation between “stuff” and happiness at all. So why bother building wealth? Here’s an easy answer. Money gives us choices. It allows us to choose how we spend our time. The world’s longest study on happiness is an 81-year (and counting) assessment called the Harvard Study of Adult Development. It continues to prove three keys to happiness:

1. Strong personal relationships

2. Keeping physically active

3. Maintaining a life with purpose

We don’t need a million dollars when we’re young. We don’t necessarily need it when we’re old. But if we put money to work, so we can build wealth, it can gift us time. If we can work less (even during our careers) that gives us more time to develop our relationships. It gives us more time to keep physically fit. And it gives us more time to live a life with purpose…especially if our jobs aren’t nurturing our souls. These are keys to happiness that we can buy with money.

Unfortunately, plenty of wealthy people don’t. They keep pursuing money, without knowing what’s “enough.” That’s a far bigger tragedy than not investing money.

I’m writing this from Bali. My wife and I are traveling, as we often do together. When we worked fulltime, we didn’t work long hours. Instead, we aimed to maximize time together. In 2014, we quit our day jobs to travel. This has boosted time for fitness, exploration and fun.

Nobody knows how long they are going to live. That’s why we need to live for today, with an eye on tomorrow. You might not have invested when you were young. You might wish you had a working time machine. But you’ll never be younger than you are today. That’s why, if you haven’t started to invest, there’s no better time than to start right now. It just might provide you with happiness and wealth.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.