Andrew Hallam

17.05.2018

Do You Want To Make Money Or Just Fool Around?

_

In his introductory article Andrew Hallam tells us about his expat journey, explores the dangers expat investors face and reveals the investment industry’s best kept secret.

I figured life was great. I taught high school English on an island in the Pacific. I could ski on weekend mornings. After lunch, I could ride my bike or kayak in the ocean. When I wasn’t grading student essays, I wrote about money. I had a freelance gig with MoneySense magazine.

It wasn’t a tropical paradise, but it was an outdoor mecca. I lived on Vancouver Island, in British Columbia, Canada. And my job provided a gold-plated pension. Upon retirement, it promised income every month until I pushed daisies.

I imagined the money rolling in, while I would bask on a tropical beach in my 60s. However, I soon asked a question that might sound familiar: “What distant gems might I be missing?”

In 2002, when I was 32 years old, I took a year off to travel. By 2003, I had landed a teaching job in Singapore. The salary was higher than what I earned in Canada. The taxes were lower. The school paid my rent. But unlike my Canadian job, it didn’t offer a pension.

Like most expats, I was jumping in deep water. I would financially sink or swim based on strokes that I would make. If I spent too much money or didn’t invest well, it would be like swimming naked. Retirement would represent the tide going out. When the tide goes out, we learn who’s swimming naked.

As a finance writer, I knew how to invest. But as I learned, financial sharks circle expatriates abroad. You might meet some at the golf course, at a party, or they’ll cold-call you at work. Unfortunately, they sell some of the world’s worst financial products. Such schemes are like ocean-going boats with fist-sized holes. They pay “advisors” nice commissions, while the hapless investors’ futures sink.

Unfortunately, these are the most commonly sold products in the expat world. That’s why I wrote, The Global Expatriate’s Guide To Investing in 2015. I wanted to expose the sharks and show investors something better.

I spoke at plenty of global venues. People would say, “Hey, you’re that guy who wrote that expat, global, something book.” The title was as memorable as anti-fungal cream. In 2018, I wrote the second edition and gave it a name that I hoped someone would remember: Millionaire Expat, How To Build Wealth Living Overseas.

Each of my books explains investing’s paradox. It’s the industry’s best-kept secret. The less you follow the stock market and rely on expert forecasts, the better you’ll perform.

I know that sounds crazy. But investing isn’t like sports, medicine, law or any professional-based skill. In fact, you could spend as little as one hour a year on your investments and beat the typical Ivy League endowment fund. You could also thrash most hedge funds.

I know, nobody taught you this in school. But Warren Buffett backs me up. A slew of Nobel Prize winners in economics say the same thing.

Investing is simple.

Here’s all you need to do: Build a diversified portfolio of low-cost ETFs. Add money every month or every quarter. Rebalance once a year. After fees, most professional investors can’t beat a diversified portfolio of ETFs.

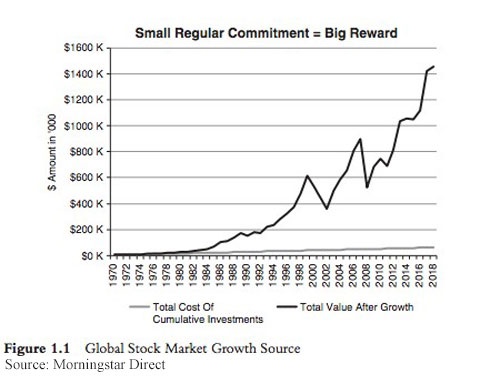

Over time, stock markets are generous–and you deserve your share. Here’s an example. Assume you had $1,200 to invest in January 1970. Every day, you added the equivalent of $3.29, or $1,200 per year. Between 1970 and February 28, 2017, you would have added a total of $57,600. But if you earned the return of the average global stock, it would have grown to more than $1.4 million. That’s a compound annual return of 10.07 percent.

Few professional investors earned anything close to that. After investment fees, the average mutual fund manager would have grown that money to about $700,000. There’s a big difference between $1.4 million and $700,000.

If you had invested that money in a typical expat pension scheme, you would have been lucky to hit $300,000.

No, I’m not pulling these numbers of out of my butt. William F. Sharpe won a Nobel Prize in economics. In a Stanford University published paper he explained that, on aggregate, investors earn what the stock market earns, minus the annual fees they pay.

Such fees are like termites. They don’t look like much. But they can easily trash your house. Over your lifetime, however, if your portfolio is diversified and low-cost, you’ll beat about 90 percent of the pros after fees. You’ll reap the rewards of the market’s gain.

This might not sound important–if you’ll be retiring with a gold-plated pension. But most expats (if they had one at all) left such promises behind when they moved abroad.

So….do you want to make money or just fool around?

Andrew Hallam is the international bestselling author of Millionaire Teacher (Wiley 2011, 2017), The Global Expatriate’s Guide To Investing (Wiley 2015) and Millionaire Expat: How To Build Wealth Living Overseas (Wiley 2018).

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.