Andrew Hallam

01.08.22

Index Investing Isn’t As Popular As Headlines Suggest

_

Media headlines are designed to grab people faster than great smelling burgers at a county fair. But in our click-bait world of slippery leads, it’s good not to be misled.

Consider the headline from this March 19, 2019 CNBC story:

Passive Investing Automatically Tracking Indexes Now Controls Nearly Half the US Stock Market

Contributor Jeff Cox wrote:

“Passive investing, made up of funds tracking market barometers, has now taken over nearly half the stock market as more investors shun stock-pickers and flock to index funds.”

Hmmm. Indexing has taken over nearly half the stock market?

Then the article progressed to say something completely different:

“Passive management now accounts for 45 percent of all assets for U.S. stock-based funds.”

Can you see the difference?

The headline and the first line say indexing makes up the vast majority of assets in the stock market. But the story’s key point says index fund investing comprises the vast majority of money in investment funds. For the record, investment funds do not comprise the majority of the money in the US stock market. Whether that headline was meant to mislead or not, Bloomberg’s March 2021 story could have caught others off-guard…if they weren’t reading carefully: Passive Likely Overtakes Active by 2026, Earlier If Bear Market.

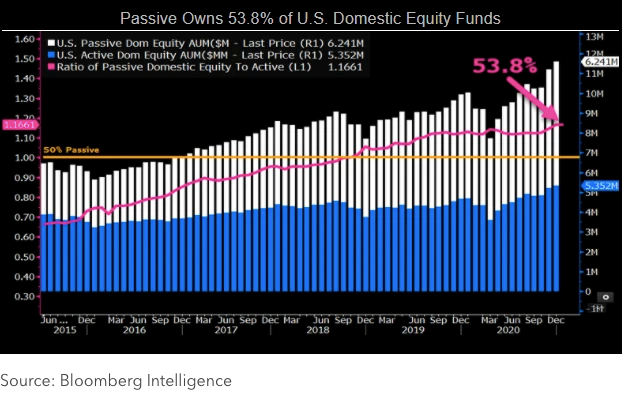

Once again, the story referred to investment funds, not passively managed money as a percentage of the overall market. It stated (as shown in the chart below) that the market-capitalisation of passive (indexed) investments in the United States represents 53.8 percent of all money invested in US investment funds. The bolded emphasis is mine. There’s a huge difference between “money in investment funds” and the total amount of money in the US stock market.

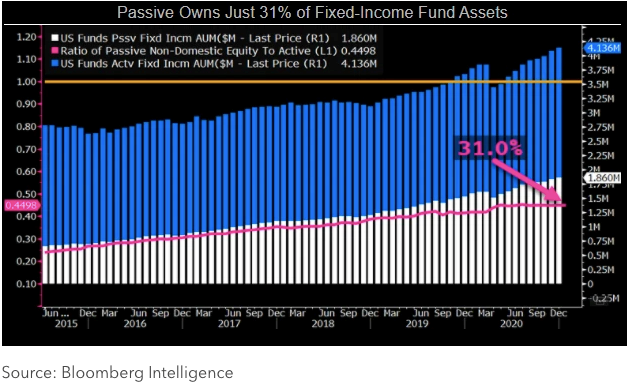

The same article stated that the market capitalisation of actively managed bond funds comprises just 31 percent of the bond fund total. In other words, Americans still have more than three times as much money in actively managed bond funds, compared to indexed (passive) bond funds.

In 2017, Morningstar’s analysis stated that about 15 percent of the assets invested in the US stock market is passively managed, leaving about 85 percent actively managed. No doubt, passive management has gained popularity as an increasing number of institutional and retail investors have caught on to the superiority of low-fee investing. But despite the increased popularity of passive investing over the past five years, it still represents a relatively small percentage of the total money invested in the US market.

That’s according to Bloomberg’s Intelligence analyst James Seyffart. He writes:

“The $6.2 trillion in passive assets still accounts for less than a sixth of the U.S. stock market, with its market cap of about $40.4 trillion.”

In other words, in 2021 passively managed money comprised about 15.34 percent of the money that was invested in the US market. Overall, that’s similar to the figure Morningstar referenced in 2017. What’s more, the percentage of passively managed money in the US bond market money is far less than 15 percent.

And then there are the international stock markets. I’m not talking about international stock market funds sold in the United States. I’m referring to something much bigger: the capitalisation of international stock market funds sold outside the United States.

The market capitalisation of passively managed funds compared to the the market capitalisation of the world’s non-US stock markets is a pittance. After all, passive investing hasn’t yet caught on internationally, as much as it has in the United States. You might wonder why we should even care about the dominance of index funds. Detractors of the low-cost strategy mostly comprise active managers. It’s no wonder they hate index funds. Indexes beat most actively managed funds. As active fund managers draw less money, such managers make less for themselves and their firms.

The minority (about 15 percent) of money invested in US stocks is passively managed. An even smaller percentage of America’s fixed income money is passively managed. Globally, the percentages are even lower. This isn’t necessarily good, nor bad. But when we see headlines–no matter what those headlines are–we need to read those stories with careful scrutiny.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.