Andrew Hallam

06.01.2021

Could You Beat the Market With These Ten Terrific Stocks?

_

They were public darlings and household names. Their corporate profits soared over the previous ten years. They were “can’t miss” stocks that thumped the S&P 500 by 143 percent. Plenty of people thought they should have seen that coming. When looking back, it seemed so obvious. And they became the ten biggest stocks in the United States. I’m not talking, however, about today’s biggest stocks.

I’m talking about the market-cap leaders in 2006. If you went back in time to 2006, they would have been all the rage. After all, they crushed the market over the previous ten years. They were market leaders that (in the eyes of many) were destined to keep winning. But something went wrong. If you invested equal amounts in those top ten stocks in 2006, Vanguard’s Total Stock Market Index (VTSMX) would have beaten them by a total of 56 percent over the decade that followed.

Could that happen to today’s ten biggest stocks? The top ten, as measured by market capitalization, include Apple, Microsoft, Amazon, Alphabet (Google), Facebook, Tesla, Berkshire Hathaway, Walmart, Johnson & Johnson and JP Morgan & Chase. As a group, they destroyed the broad market index over the previous ten years. But here’s an ominous statistic that is so darn common it has practically become a law: On average, the ten biggest stocks at the beginning of the year lose to the U.S. stock index over the decade that follows.

Impossible, you say? That’s what people would have said in 1940, 1960, 1990, 2010 and every year in between. But as a group, the ten biggest companies disappointed people after gaining their position among the biggest ten.

Research Affiliates’ Robert D. Arnott, Jason C. Hsu and John M. West began their research by looking at the ten biggest stocks in 1926. They then looked at how those ten biggest stocks performed going forward. The researchers found that those market leaders (which had typically beaten the market over the previous ten years) failed to do so as a group over the decade that followed. That wasn’t an aberration. The same thing occurred during all 81 decade-long periods from 1926 to 2006. To be fair, some of those stocks continued to perform well. But as a group, they failed. The S&P 500 beat them, on average, by a total of 29.4 percent over the next ten years.

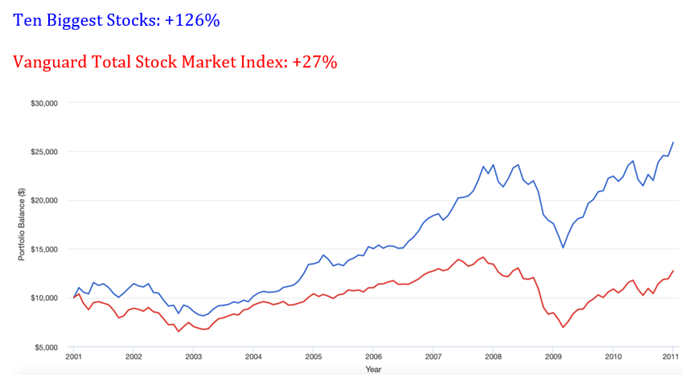

That study ended in 2006, so I extended Arnott, Hsu and West’s research from 81 to 87 measured periods. The last period looked at the ten biggest stocks in 2011. As usual, in the previous ten years, they crushed the market. From January 2001 to December 31, 2010, they beat the U.S. stock market index by almost 125 percent. But as a group, they didn’t keep winning. From January 2011 to November 30, 2020, Vanguard’s Total Stock Market Index beat them by 116 percent.

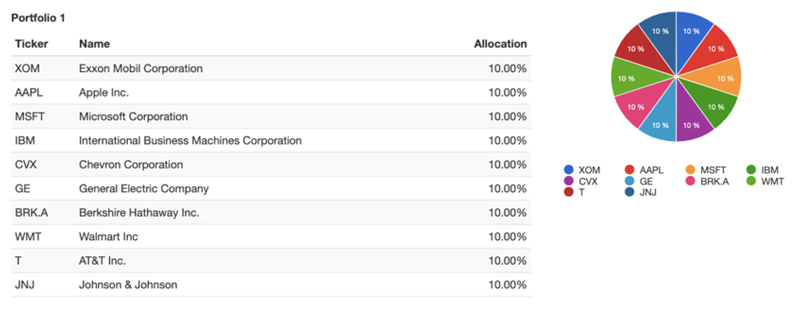

America’s Ten Biggest Stocks In 2011

Past Growth That Put Them Among The Biggest Ten

January 1, 2001-December 31, 2010

Ten Years Later, Fortunes Reversed

Of the 87 measured periods, the ten biggest stocks beat the U.S. stock market index only once in the decade that followed. That occurred with the 10 biggest stocks in 2009. Over the following decade (ending December 31, 2018), they averaged a compound annual return of 13.93 percent. That edged out Vanguard’s Total Stock Market Index (VTSMX). It averaged 13.13 percent over the same time period. That’s hardly the kind of margin that promotes confidence.

In most cases, the ten biggest stocks lag because they become too expensive. Their strong corporate growth made them popular. That increased demand and pushed their share prices high. That results in higher than average price-to-earnings ratios. Such is the case with the ten biggest stocks today. Their corporate business earnings have been impressive. But most of them have seen their stock prices rise far faster than their corporate earnings.

If you’re pegging your hopes on today’s ten biggest stocks, you might say, “This time is different.” And you might be right. But disappointment usually follows those four common words. To paraphrase Mark Twain, history doesn’t repeat itself. But it does rhyme.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.