Andrew Hallam

01.12.2020

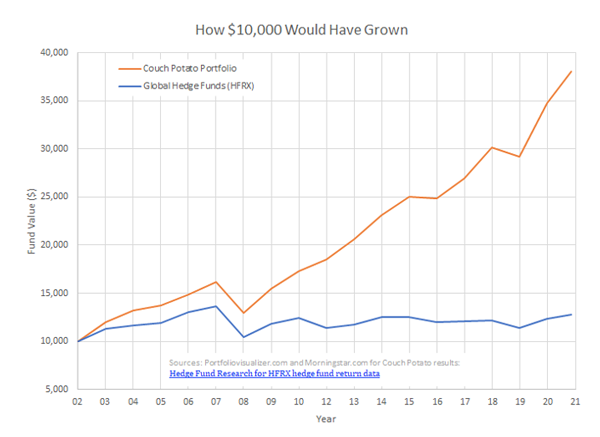

The Couch Potato Portfolio Makes Hedge Funds Look Silly

_

Imagine a planet similar to ours. Somebody creates a 2-speed bicycle. Others figure they can build something better. They add several gears. Then they add an internal combustion engine. Not long after, an electric engine follows.

And what if, despite their attempts to innovate, these new bikes end up slower? This planet might sound like a backward place. But that topsy-turvy aligns with an investment story here.

In 1991, Scott Burns created the investors’ equivalent of a 2-speed bike. It included an equal split between a U.S. stock market index and a U.S. bond market index. Once a year, investors rebalance the portfolio back to its original allocation.

It’s simple, yet it thrashes the performance of most hedge funds. It beats them when stocks rise. And it beats them when stocks fall.

I first compared hedge funds to Burns’ Couch Potato portfolio back in 2012. For ten years in a row, simplicity beat complexity. Since then, the performance gap between hedge funds and the Couch Potato has grown even wider. Over the past 8 years, the Couch Potato beat the HFRX hedge fund index by almost 7 percent, per year.

Some people might say, “The only reason they lost is because hedge funds are expensive.” That’s partly true. They do cost a lot. The typical hedge fund charges about 2 percent per year, plus 20 percent of any profits earned. In contrast, the Couch Potato portfolio is a far cheaper ride. Investors could build an equivalent portfolio of ETFs for about 0.15 percent per year.

But high fees don’t fully explain why hedge funds lag. After all, they lose by a far higher percentage than the fees they charge. In fact, from 2003-2020 hedge funds could have charged no fees, yet the Couch Potato portfolio would have still left them far behind.

You might not own a hedge fund. But there’s still a lesson here. Most people invest in portfolios that are far more complex than the simple Couch Potato. But sophistication and profits don’t typically go hand-in-hand.

Hedge fund managers are smart. They work really hard. They use sophisticated strategies in attempts to buy the best stocks, time the market, short the market (if they think stocks will fall) and shift money into alternative investments when they think the time is right. But most hedge funds still lag a simple two-part portfolio for three main reasons:

Nobody can consistently time the market.

Nobody can consistently buy market-beating stocks.

Nobody can consistently shift money into the best alternative asset classes.

That’s why, if hedge fund managers can’t do it, then why would you bother to try?

Instead, build a portfolio of low-cost index funds or ETFs. It could be a 2-speed portfolio like the original Couch Potato. It could be a 3-speed portfolio that includes international stocks. It might even be an all-in-one portfolio of index funds.

Just keep costs low and stay the course.

Scott Burns was right.

Low-cost simplicity trumps sophistication.

| Year | Global Hedge Funds (HFRX) | Couch Potato Portfolio |

|---|---|---|

| 2003 | 13.40% | 19.68% |

| 2004 | 2.70% | 10.38% |

| 2005 | 2.70% | 4.29% |

| 2006 | 9.30% | 7.97% |

| 2007 | 4.20% | 8.54% |

| 2008 | -23.30% | -19.94% |

| 2009 | 13.40% | 19.75% |

| 2010 | 5.20% | 11.63 |

| 2011 | -8.80% | 7.10% |

| 2012 | 3.51% | 11.51% |

| 2013 | 6.72% | 12.22% |

| 2014 | -0.58% | 8.13% |

| 2015 | -3.64% | -0.77% |

| 2016 | 0.86% | 8.53% |

| 2017 | 0.73% | 11.93% |

| 2018 | -6.70% | -3.37% |

| 2019 | 8.62% | 19.35% |

| 2020 (11/09/20) | 3.19% | 9.48% |

| Compound Annual Average | 1.4% | 7.79% |

Sources: Portfoliovisualizer.com and Morningstar.com for Couch Potato results; Hedge Fund Research for HFRX hedge fund return data.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.