A GREAT FUTURE, TOGETHER

Keytrade Bank Luxembourg has joined Swissquote Bank Europe to form the leading online

trading and investing bank in Luxembourg.

A message for Keytrade Bank Luxembourg clients:

We’re delighted that Keytrade Bank Luxembourg has joined Swissquote Bank Europe to form the leading online trading and investing bank in Luxembourg.

Many of you already knew Swissquote Bank Europe (formerly Internaxx Bank), as a pioneer of online stock trading in Luxembourg. And as a client of Swissquote, you gain access to new services and platforms, lower fees, and the support of a group that serves over 450'000 clients worldwide. Swissquote is listed on the SIX Swiss Exchange (symbol: SQN), and has offices around the globe.

On 1st May 2022, your Keytrade Bank Luxembourg account has become a Swissquote Bank Europe account. Your investment representatives at Keytrade have joined the Swissquote team. You have gained access to new platforms and a broader range of investment products, including new markets such as Tokyo, Hong Kong, Singapore and Sydney, cryptocurrencies, plus derivatives including CFDs and our new options trading service.

Rest assured your account is still be based in Luxembourg. And you will also benefit from our lower pricing, with no custody or account fees, trades from just €14.95 on European and international markets, and other unique advantages.

We're happy to have you on board to support your trading and investing objectives. If you have any questions about our products and services, please visit our Questions & Answers below.

Sincerely,

Dave Sparvell

CEO, Swissquote Bank Europe

Questions & Answers

_

Most frequently asked questions

You have been issued new credentials to log into your new Swissquote account. Swissquote has sent your new username at your postal address (if we do not hold a valid postal address on file or if live outside Europe, Swissquote has sent instructions by email on how to obtain your new username).

Please note that joint account holders will share the same username and password.

Your open positions and cash deposits have automatically been moved during the migration on 1st May.

Your old Keytrade Bank Luxembourg IBAN will no longer work from Friday 29th April. Once you have access to your Swissquote account from 2nd May, you will find your new banking details under the Payments & Transfers section. This new IBAN will enable you to fund your account in any of the 20+ currencies available on the Swissquote platform. To avoid delays in crediting your account, or having your transfer rejected, please make sure you quote the exact account holder name(s) as the beneficiary of the payment, using your new IBAN and BIC (SWQBLULL).

If you need help accessing your account once it is transfered to Swissquote, please send Swissquote an email to login@swissquote.lu or call us on +352 45 04 39. If you need to place a trade urgently please call Swissquote on +352 2603 2003, and press 3. For all other migration enquiries, you can reach Swissquote at migration@swissquote.lu or on +352 45 04 39.

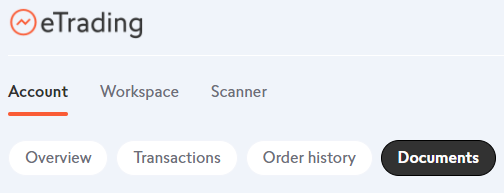

Your Keytrade documents have been migrated to your new Swissquote account(s). To access your documents, please log in and visit the Documents section located on the Account page.

Yes it is possible to consolidate your accounts to one. Please send us your instructions to merge and close the duplicated accounts by secure message. By default, your receiving account will be the Swissquote account corresponding to your Keytrade Bank Investment account. Your secure mailbox is accessible under: My Account, Messages.

Your KEYPLAN or KEYPRIVATE accounts have been migrated to Swissquote. Swissquote offers hassle-free, low cost solutions to invest for the long term with its Smart Portfolios.

When migrating your Keytrade Bank Luxembourg account(s), the securities held in your KeyPlan/KeyPrivate are automatically transferred to a new Swissquote trading account, you will have then two options: you can choose to self-manage your existing investments, or opt to convert your account to Swissquote's Smart Portfolios. Smart Portfolios are a hassle-free solution to invest for the long term, based on four investment profiles, combining the renowned asset management expertise of BlackRock, portfolio diversification, regular investing and low fees.

| Keyplan | Swissquote Smart Portfolios |

|---|---|

| Sustainable | Sustainable Multi-asset |

| Cautious | Defensive |

| Balanced | Moderate |

| Audacious | Growth |

Swissquote Bank Luxembourg will assist you in May to help you choose the option that best suits your investment objectives.

About the acquisition of Keytrade Bank Luxembourg by Swissquote Bank Europe

Swissquote Bank Europe with its state-of-the art technological platform and Keytrade Bank Luxembourg with its strong domestic presence will complement their respective strengths and wealth of proven expertise to form the leader of digital investing services in Luxembourg. The transaction will further increase Swissquote’s regional footprint.

Previously known as Internaxx Bank, Swissquote Bank Europe is Luxembourg’s leading online bank for investors and traders, and has been at the forefront of online investing for over 20 years. Swissquote Bank Europe offers a multi-currency investment account and access to international stocks, ETFs, investment funds and cryptocurrencies, all with the convenience of web and mobile platforms and the support of a client servicing team also based in Luxembourg. Other services include Credit Lombard for margin trading, Forex, CFDs, and Smart Portfolios, a managed account solution built with low-cost ETFs.

Swissquote Bank Europe holds a banking license issued by the Commission de Surveillance du Secteur Financier (CSSF) under the authority of the European Central Bank (ECB). Swissquote Bank Europe is a fully owned entity of Swissquote Group Holding Ltd. Swissquote Group Holding Ltd is listed on the Swiss stock exchange SIX (symbol: SQN) and also owns Swissquote Bank Ltd, Switzerland’s leading online bank.

Swissquote Bank Europe is also based in Luxembourg and regulated as a Bank, so you will continue to enjoy the financial consumer protections and guarantees as you did, as well as the added reassurance that a large publicly traded banking group can provide.

On top of that, you will gain access to new services and platforms, and the support of a group that serves over 450'000 clients worldwide. You will also benefit from our low pricing, with no custody or account fees, trades from just €14.95 on European, US and Canadian markets, and unique advantages and discounts for qualifying accounts.

Your protections will not change. Your account will still be based in Luxembourg. Swissquote Bank Europe operates under the supervision of the CSSF, and has a full bank status, like Keytrade Bank Luxembourg. As such, Swissquote Bank Europe is also a member of the Luxembourg Deposit Guarantee Fund (FGDL). The FGDL protects all investors by guaranteeing deposits up to the amount of €100'000 per person. Your securities assets are not held directly with the Bank but in Nominee with Central Securities Depositaries (CSDs) and other investment grade custodians. These assets are segregated from the assets of the Bank and permanently identifiable as yours as the beneficial owner.

Swissquote Bank Europe SA has a data protection agreement with its sister company, Swissquote Bank Ltd (a Swiss-based company), leveraging the group's infrastructure for data processing. Client data is subject to the same professional secrecy obligations as in Luxembourg. General Data Protection Regulation (GDPR) equivalence has been granted to Switzerland by the European Commission, as the Swiss regime is considered to offer the same level of rights and protection. Safety measures include the pseudonymisation and encryption of Personal Data.

About our services

Swissquote has the resources, scale and platforms to provide you with the broadest range of market-leading products and services. You will gain access to a broader range of stocks and ETFs (trackers) trading on additional markets such as Tokyo, Sydney, Hong Kong, and Singapore; to a much wider range of funds, plus our soon to be launched options trading service. We also offer cryptocurrencies and derivatives including CFDs on stocks, indices, forex and commodities.

If you’re looking for a managed account, our Smart Portfolios are an automated low-cost investing solution managed by experts, with flexible regular investment options.

Our trading account supports multiple currencies so you can trade international markets and settle in local currencies, or any currency of your choice amongst more than 20. Our list of available currencies is available here.

You have access to the main stock exchanges of the following countries: USA, Canada, UK, Germany (including regional exchanges), France, Netherlands, Belgium, Switzerland, Spain, Italy, Austria, Sweden, Denmark, Finland, Norway, Australia, Hong Kong, Japan and Singapore.

Swissquote offers you the ability to trade across web and mobile applications with access to an efficient platform and intuitive tools, to help you reach your full trading potential.

Our multi-asset platform - called eTrading - was designed to enable our clients to achieve their investment objectives in the simplest and most intuitive way. It offers many features including widgets to create your personal workspace, integrated watchlists, financial news and a quick search tool. Over 100’000 products are accessible through this single platform.

Please visit our series of video tutorials to guide you through the functionalities of our eTrading platform.

Yes, you will have access to a wider universe of funds, covering more asset managers, categories, sectors, currencies, plus you will be able to save more with our extensive range of clean funds. You will have access to 10’000+ offshore funds from over 200 investment firms, and 3’000 lower cost clean funds. Unlike traditional funds distributed by most banks and brokers, clean funds are stripped out of hidden fees and kick-backs, so you can save you up to 50% on your annual management fees.

With Swissquote, you can trade over 1.7 million structured investment and leverage products listed on Euwax – the largest European exchange for securitised derivatives trading. This large range of products offers you investment opportunities tailored to different risk preferences. Euwax is a major exchange-based trading hub for investment certificates such as Bonus and Discount Certificates, Reverse Convertible Bonds, as well as for leverage products, including Warrants, Knock-out Warrants (Turbos), Mini-futures and Constant Leverage Certificates.

Structured products are charged Swissquote standard trading rate of 0.1% (min. 14.95 EUR).

Yes. You have access to Eurex (Europe) and ISE (US). It's possible to write options either using the underlying to cover your short option or with a margin calculation if the option is not covered.

Positions in bonds have been migrated to your new Swissquote account but will not be tradable online. Swissquote will support offline bonds trading on a sale only basis.

Swissquote’s Credit Lombard lets you use the securities and cryptocurrency holdings in your account to borrow money at competitive rates.

Fully online, the intuitive Lombard feature allows you to monitor the evolution of your buying power in real time, allowing you to modify your loan limit and request additional margin through your account.

You are only charged for the amount that you actually borrow. We do not charge a loan commission.

Yes, Swissquote VIP Program is your fast track to our best prices, priority support and other exclusive benefits. Reserved to accounts with €1m or more, our VIP Platinum and Apex status give you access to an investing experience of the highest calibre.

No, as your account remains a Luxembourg-based account, it's not subject to the Swiss transaction tax.

We will assist Belgian residents by providing a monthly tax report listing all necessary information required to file and pay the tax to the Belgian tax authorities. The applicable rates and amounts of tax will be pre-calculated, so that clients don't have to calculate themselves. The report will be available in the Documents section of your Swissquote account.

About our pricing

Yes, you benefit from our low pricing, with no custody or account fees, trades from just 14.95 € on European, US and Canadian markets, lower Margin Trading / Lombard rates and unique advantages and discounts for qualifying accounts.

Find out more about our pricing, please click here.

Swissquote does not charge an account maintenance fee for clients residing in the EU. Keytrade clients residing outside of the EU will not be charged an account maintenance fee throughout 2022.

Find out more about our pricing, please click here.

Yes, our Trade Bundles are the perfect solution for active traders. Choose the number of trades you want to execute over one year and automatically benefit from our special conditions, allowing you to reduce your effective cost down to as little as 0.06%.

Find out more here.

Yes, our VIP program can help you take your investing to the next level. Click here for more information.

About the transition to Swissquote Bank Europe

On May 1st, 2022 your Keytrade Bank Luxembourg account became a Swissquote Bank Europe account and your investment representatives at Keytrade joined the Swissquote team.

Your account's assets - cash and securities - were automatically migrated without requiring any action on your part.

No, you have received new credentials to log in to your Swissquote account. If you have not received your credentials please send us an email at login@swissquote.lu.

Yes it is possible to consolidate your accounts to one. Please send us your instructions to merge and close the duplicated accounts by secure message. Please confirm the accounts to close and the receiving account for your consolidated assets.

Your secure mailbox is accessible under : My Account, Messages.