Andrew Hallam

06.03.22

Yes, There Are Savings Accounts That Pay High Interest Rates

_

In 2019, I spent the winter in Mexico. Mexican banks paid savings account holders about 3.5 percent per year. Plenty of Americans in Mexico celebrated with tacos and tequila. They told me, “I don’t need to keep my cash in a US bank account because I earn much higher interest in a Mexican bank.” Over the years, I’ve heard the same arguments from expats living in other emerging market countries. In some cases, these expats didn’t invest in the global stock and bond markets because they earned high returns on their local savings accounts.

Unfortunately, this is often a mirage…especially if these expats plan to eventually repatriate to their home countries. For example, according to Trading Economics, from 2003 to 2021 Mexican savings accounts paid annual interest ranging from 0.59 percent to about 3.6 percent per year.

On the surface, such returns look worthy of celebration. But looks are deceiving. American and European savings accounts actually paid more. No, I’m not talking crazy. Those Mexican bank accounts measured their returns in pesos. And from 2003 to 2021, the US dollar almost doubled in value, compared to the peso. In other words, just to keep up with the rising US dollar, Mexican savings accounts (measured in pesos) would have needed to average 3.8 percent per year. And Mexican savings accounts didn’t do that.

As paltry as the interest rates were for US savings accounts were, they beat the returns of Mexican savings accounts, if the money were measured in a common currency.

When someone works in a foreign country (and they don’t plan to retire there) pegging their retirement on the stability of that country’s currency means they are taking unnecessary risks. If the foreign currency drops compared to the expatriate’s home country currency, the higher interest rate in foreign banks becomes a smoke and mirror show.

I met some Europeans and Indian nationals that were so pleased with the interest they were earning on Indian savings accounts that they didn’t bother to invest in the global stock and bond markets. But they were also fooled.

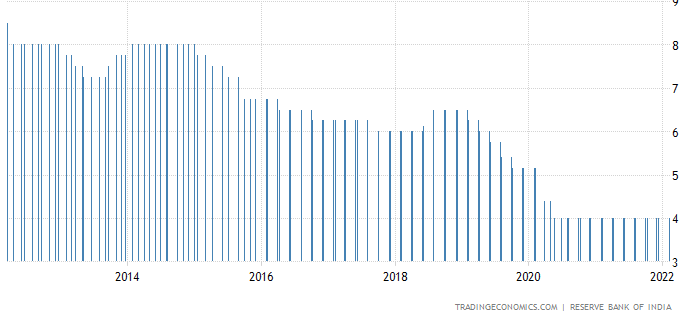

Historical Savings Account Interest Rates In India

Currently, Indian banks pay 4 percent per year in interest. Over the past 10 years, they averaged about 6.5 percent per year. That sounds great, until we measure that return in a different currency. Ten years ago, 65 Indian rupees could buy one euro. However, in March 2022 it required 84 rupees to buy that same euro. That means, the euro increased by 29 percent, compared to the rupee. The US dollar increased by about 69 percent, compared to the Indian rupee. The Swiss franc gained about 57 percent, and the British pound gained about 39 percent over the same time period.

Suddenly, those Indian savings account rates don’t look great at all. Here’s another way of measuring how well they performed. Measured in US dollars, the global stock market index averaged 9.8 percent per year, measured over the 10 years ending March 4, 2022. That’s a total return of 154 percent.

But measured in Indian rupees, that same global stock market index gained about 224 percent over the past ten years. That’s a heck of a lot better than an Indian bank’s savings account.

The Russian ruble provides another example. Over the past ten years, Russian savings accounts paid some spectacularly high interest rates. As shown below, interest rates peaked at more than 13 percent in late 2014. They currently pay about 5.2 percent per year. And over the past ten years, they averaged almost 7 percent per year.

Russian Savings Account Interest Rates

Awesome right? Nope!

Americans, Europeans, Brits and Canadians would have made more money in one of their home country savings accounts, compared to what they would have earned if they deposited money in a Russian bank. After all, over the past ten years ending March 2022, the US dollar gained a whopping 275 percent on the Russian ruble.

That means, an American bank’s savings account could have lost several percentage points every year for a decade and still beaten the return on a Russian bank account, when measured in USD.

Russian-based expats might say, “That’s not a fair analysis. The ruble recently crashed based on Russia’s conflict with Ukraine.” That’s true. But if we measure the 10-year period ending January 2022 (before the ruble crashed) the USD still gained about 150 percent on the Russian currency. Most other global currencies destroyed the ruble too.

I’m not saying a hard-hit emerging market currency can’t recover and soar. But if you’re temporarily living in a foreign country, don’t stockpile large sums of cash in local savings accounts, even if they promise high rates of interest. When measured properly, you might not earn the returns you expect. And if that country’s bank freezes your account (in 2002, it happened in Argentina) that’s a frightening mess you’ll want to avoid.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.